When should I sell a stock at a loss

When To Sell And Take A Loss. According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price, no exceptions.

At what percent loss should you sell

Live to invest another day by following this simple rule: Always sell a stock it if falls 7%-8% below what you paid for it. No questions asked. This basic principle helps you cap your potential downside. And it's the simplest way to make sure you never let a small loss become a BIG one.

Should you sell a stock if it goes down

Similarly, it's usually a bad idea to sell a stock only because its price decreased. At the same time, though, sometimes you just have to cut your losses on a stock position. It's important to not let a drop in a stock's price prevent you from selling.

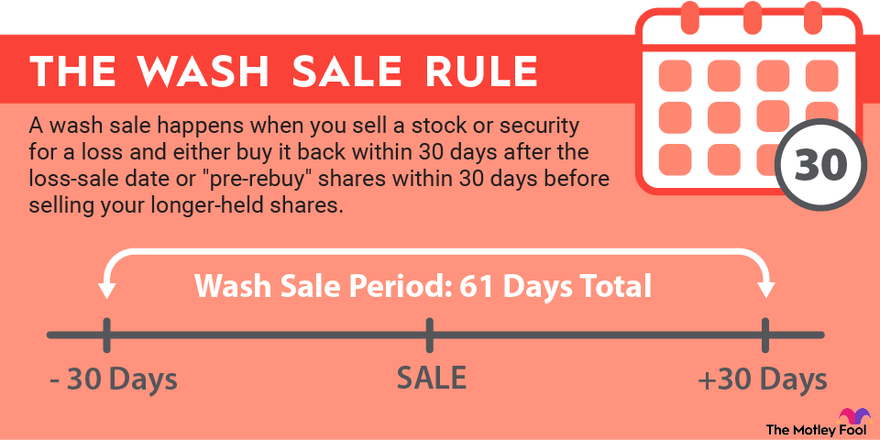

Do you have to wait 30 days to sell a stock at a loss

A wash sale is an IRS rule that prevents a loss being taken on the sale of a security if that same security or a substantially identical one is then bought within the same 30 day period.

Can I sell a stock at a loss within 30 days

Q: How does the wash sale rule work If you want to sell a security at a loss and buy the same or a substantially identical security within 30 calendar days before or after the sale, you won't be able to take a loss for that security on your current-year tax return.

Should I sell at 20% profit

Here's a specific rule to help boost your prospects for long-term stock investing success: Once your stock has broken out, take most of your profits when they reach 20% to 25%. If market conditions are choppy and decent gains are hard to come by, then you could exit the entire position.

Is it true that 95 percent of traders lose

Intraday trading is the most popular, yet data suggests that most intraday traders lose money. A 70 percent don't last beyond the first year, and 95 percent stop trading by the third year.

Is it better to sell stocks when high or low

The “Buy Low & Sell High” investment strategy is all about timing the market. You buy stocks when they've hit a bottom price, and you sell stocks when their price peaks. That's how you can generate the highest returns.

How long should you hold a stock for

For a holding period of less than one year, any gains will be taxed at a person's marginal income tax rate. By holding onto a stock for more than one year, an investor will likely lower their tax burden. It can be helpful for investors to speak with a certified tax professional before adopting any tax strategy.

Do I have to wait 2 days to sell a stock

For most stocks, the standard period to receive the proceeds of a stock sale is two days. This is known as the T+2 settlement period.

What is the 30-day stock loss rule

The wash-sale rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. So, just wait for 30 days after the sale date before repurchasing the same or similar investment.

How long does it take to recover a 20% loss in stock market

So, how long does it take for stock markets to recover The data shows that since 1950, stock market pullbacks typically recover their losses within 19 months of markets bottoming out on average. When stock markets decline less than 22%, the average recovery was only seven months.

Is a wash sale 30 or 60 days

The wash-sale rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. So, just wait for 30 days after the sale date before repurchasing the same or similar investment.

Should I sell stock at 25 percent

When buying a stock, estimate a percentage you plan to sell at. For example, you may sell a position when it profits 20% to 25%. Once you reach this number, sell some or all of the position, or reevaluate your goals. On the other end, a “stop loss” helps minimize losses in a sharp downturn.

What is the 25% profit rule

The 25% rule also refers to a technique for determining royalties, which stipulates that a party selling a product or service based on another party's intellectual property must pay that party a royalty of 25% of the gross profit made from the sale, before taxes.

Do 97% of traders lose money

On any given day, 97% of day traders lose money net of trading fees. This data suggests that new investors decide to begin day trading only because they are overconfident in their ability to be profitable at it.

Why 99% of traders lose money

Over trading is a scenario where one tries to take too many trades in a single day. Traders want to take advantage of every dip and fall. This is a psychological trait that people don't want to lose. And in order to recover those previous losses, young traders take another shot to break even.

What is the 10 am rule in stocks

The idea behind this rule is that the first 30 minutes of the trading day, from 9:30 am to 10:00 am, often experiences higher volatility due to overnight news, early morning earnings reports, and the initial rush of buy and sell orders from traders.

What is the 8 week hold rule

What is the 8-week hold rule in stock investing The 8-week hold rule, developed by Investor's Business Daily (IBD), states that if a stock gains upwards of 20% within 1-3 weeks of a proper breakout, it should be held for eight weeks, as such stocks often become the market's biggest winners.

Should I sell my losing stocks at the end of the year

3. You need the cash. There's an adage among traders: Let your winners run. If you don't want to sell your winners prematurely, it might make more sense to generate the necessary income by selling your losers—which may allow you to offset up to $3,000 a year in ordinary income in the process.

How long does Warren Buffett hold stocks

And that's what makes Buffett and Munger so extraordinary, as simple as it may sound: their uncanny ability to hold onto stocks for decades at a time, even in the face of some really scary economic headlines. Berkshire has owned the top five stocks in its portfolio for an average of 17 years!

Is it OK to buy a stock and sell it the next day

A common rule among day traders is to always end their day without any stock positions, so they must sell their positions at the end of the day. Retail investors who want to avoid day trading rules may purchase stocks at the end of the day, so they are free to sell them the next day if they wish.

What is the stock 3 days rule

The three-day settlement rule states that a buyer, after purchasing a stock, must send payment to the brokerage firm within three business days after the trade date. The rule also requires the seller to provide the stocks within that time.

What is the 50% rule in stocks

Understanding the Fifty Percent Principle

The fifty percent principle predicts that when a stock or other security undergoes a price correction, the price will lose between 50% and 67% of its recent price gains before rebounding.

What is the 80% rule in trading

–If the market opens up inside of value and then trades out of value, the rule applies the same way. If the market can trade back inside value for two consecutive 30 minute periods, then it has an 80% chance of rotating to the other side of value.