Can I sell a stock first and buy later

If you are completely new to shorting, just remember this one point for now – When you feel the price of a stock is likely to decline, you can make money by shorting the stock. To short stock or futures, you will have to sell first and buy later.

Can we sell shares and buy later

While there is no rule stopping you from buying shares online after you have sold them before, there are certain regulations about the reason for sale. When you buy stocks online after you have sold them previously, you must be cognizant of particular aspects of the transaction.

Can I sell a stock and buy another immediately

Retail investors can buy and sell stock on the same day—as long as they don't break FINRA's PDT rule, adopted to discourage excessive trading.

Is it illegal to keep buying and selling the same stock

There are no restrictions on placing multiple buy orders to buy the same stock more than once in a day, and you can place multiple sell orders to sell the same stock in a single day. The FINRA restrictions only apply to buying and selling the same stock within the designated five-trading-day period.

What happens if I sell a stock and then buy it again

The wash-sale rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. So, just wait for 30 days after the sale date before repurchasing the same or similar investment.

Is it illegal to short sell stocks

It is illegal—the legal way to short sell is to first borrow the shares before selling and opening up a short position. Naked short selling, or naked shorting, is the process of selling shares of an investment security that have not been confirmed to exist.

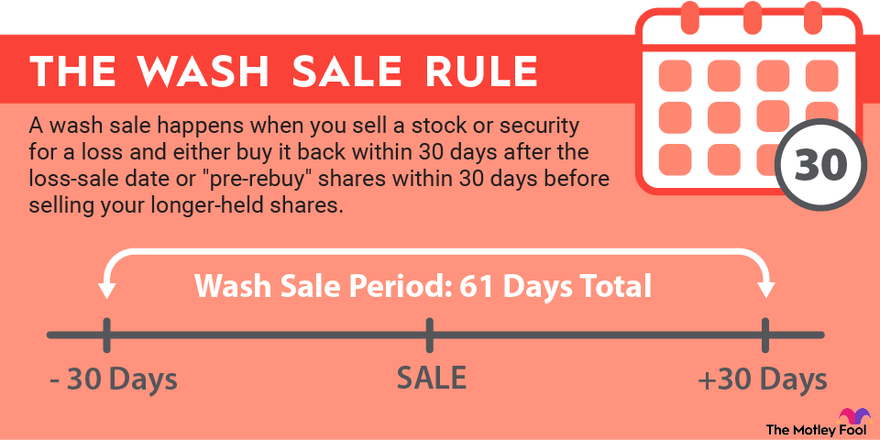

What is the wash sale rule 30 days before

Q: How does the wash sale rule work If you want to sell a security at a loss and buy the same or a substantially identical security within 30 calendar days before or after the sale, you won't be able to take a loss for that security on your current-year tax return.

What is the 3 day rule in stocks

The three-day settlement rule states that a buyer, after purchasing a stock, must send payment to the brokerage firm within three business days after the trade date. The rule also requires the seller to provide the stocks within that time.

What is 3 day rule in stocks

Investors must settle their security transactions in three business days. This settlement cycle is known as "T+3" — shorthand for "trade date plus three days." This rule means that when you buy securities, the brokerage firm must receive your payment no later than three business days after the trade is executed.

How long do you have to wait after selling a stock

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

Who are the biggest short sellers

8 Most Famous Short Sellers in HistoryJesse Livermore.Jim Chanos.Andrew Left.David Einhorn.John Paulson.Bill Ackman.Carson Block.George Soros.

Can you short stocks below $1

The $2.50 rule is a rule that affects short sellers. It basically means if you short a stock trading under $1, it doesn't matter how much each share is — you still have to put up $2.50 per share of buying power.

What triggers a wash sale rule

A wash sale occurs when a stock or security is sold at a loss and another identical or like-kind stock of security is purchased within 30 days, before and after the sale.

Do you have to hold a stock for 30 days to avoid wash sale

More specifically, the wash-sale rule states that the tax loss will be disallowed if you buy the same security, a contract or option to buy the security, or a "substantially identical" security, within 30 days before or after the date you sold the loss-generating investment (it's a 61-day window).

What is 90% rule in trading

There's a saying in the industry that's fairly common, the '90-90-90 rule'. It goes along the lines, 90% of traders lose 90% of their money in the first 90 days.

What is the 1% rule for day trading

A lot of day traders follow what's called the one-percent rule. Basically, this rule of thumb suggests that you should never put more than 1% of your capital or your trading account into a single trade. So if you have $10,000 in your trading account, your position in any given instrument shouldn't be more than $100.

What is the 1% day trading rule

Ideal position size will vary by strategy and portfolio size, but a good rule of thumb is you shouldn't risk much more or less than 1% of your portfolio on each trade.

What happens if you sell a stock before 30 days

Q: How does the wash sale rule work If you want to sell a security at a loss and buy the same or a substantially identical security within 30 calendar days before or after the sale, you won't be able to take a loss for that security on your current-year tax return.

Why is short selling illegal

There are several reasons why a country might ban short selling. Some believe short selling en masse triggers a sale spiral, hurting stock prices and damaging the economy. Others use a ban on short sales as a pseudo-floor on stock prices.

Why do short sellers lose money

Losses for short-sellers can be particularly heavy during a so-called short-squeeze, which can occur when a heavily shorted stock unexpectedly rises in value, triggering a cascade of further price increases as more and more short-sellers are forced to buy the stock to close out their positions.

What happens if I short a stock and it goes to $0

When this happens, the short-seller needn't worry. They don't need to give the shares they borrowed back as they are now worthless. They just wait for the broker to declare a total loss on the loaned stock, cancel the debt, and return all collateral.

How long do you have to wait to buy a stock after selling it

within 30 days

The wash-sale rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. So, just wait for 30 days after the sale date before repurchasing the same or similar investment.

What is the 7% loss rule

Highly successful stock pickers go through similar training: They must learn how to cut their losses short. This means selling a stock when it's down 7% or 8% from your purchase price. Sounds simple, but many investors have learned the hard way how difficult it is to master the most important rule in investing.

What is the penalty for a wash sale

Wash Sale Penalty

A wash sale itself is not illegal. Claiming the tax loss on a wash sale is, however, illegal. The IRS does not care how many wash sales an investor makes during the year. On the other hand, it will disallow the losses on any sales made within 30 days before or after the purchase.

What is rule 21 in stock market

The relationship can be referred to as the “Rule of 21,” which says that the sum of the P/E ratio and CPI inflation should equal 21. It's not a perfect relationship, but holds true generally. What can we infer from this information for today's market