When did old GM stock became worthless

The old GM stock stopped trading on the New York Stock Exchange on June 1, 2009, the day that GM filed for bankruptcy.

What happens if a stock hits $0

If a stock falls to or close to zero, it means that the company is effectively bankrupt and has no value to shareholders. “A company typically goes to zero when it becomes bankrupt or is technically insolvent, such as Silicon Valley Bank,” says Darren Sissons, partner and portfolio manager at Campbell, Lee & Ross.

How low will GM stock go

GM Stock 12 Months Forecast

Based on 13 Wall Street analysts offering 12 month price targets for General Motors in the last 3 months. The average price target is $46.17 with a high forecast of $85.00 and a low forecast of $35.00. The average price target represents a 16.11% change from the last price of $39.77.

Is GM stock worthless

Shares in old General Motors do have value, sort of, to somebody. If you are a shareholder in old General Motors — whose symbol was GM before becoming GMGMQ in bankruptcy — which is now called Motors Liquidation Co., don't get your hopes up. The shares are still essentially worthless.

Bản lưu

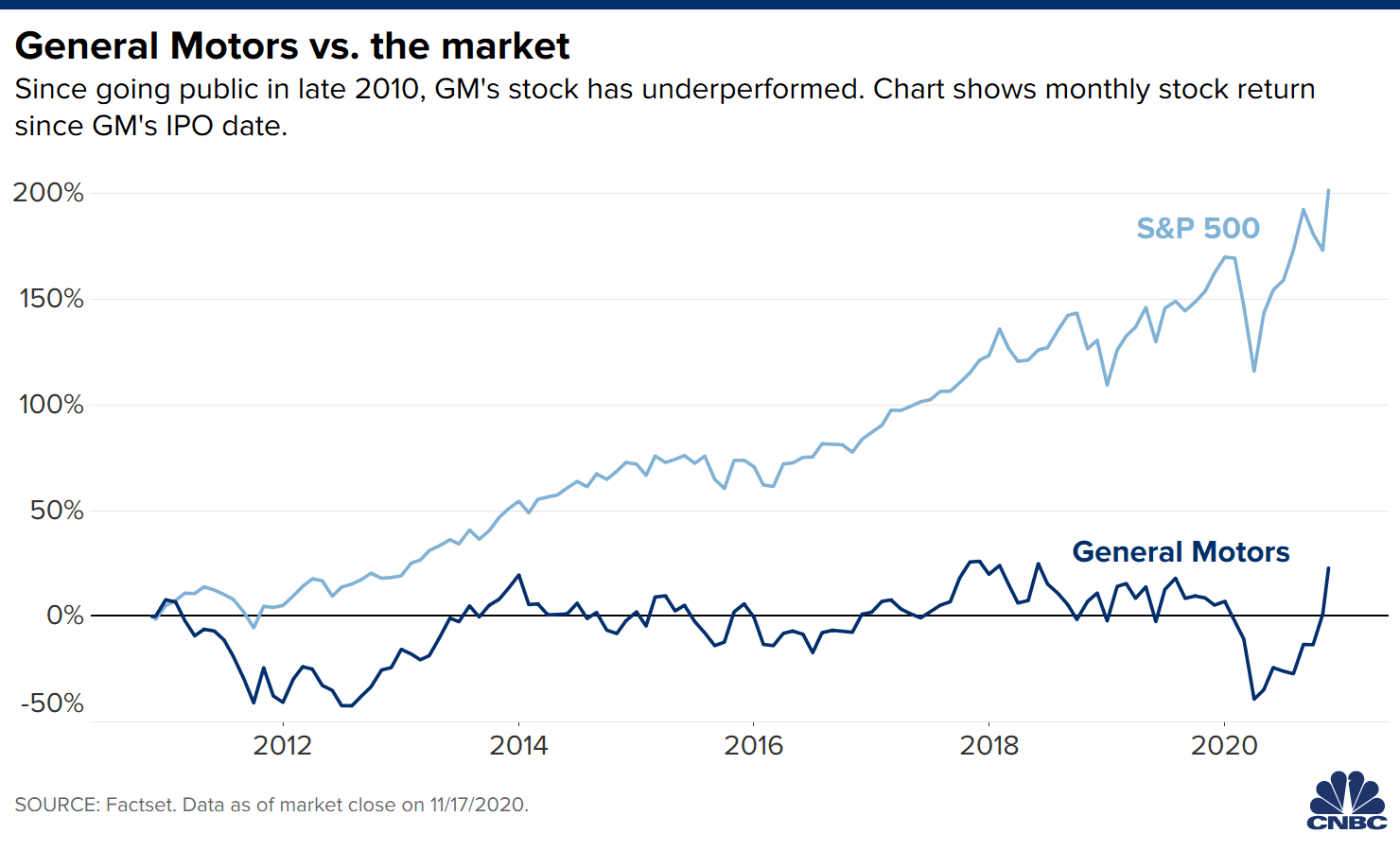

Is GM a good long term stock

While GM has slightly exceeded the S&P 500's gain in the last three years, the stock has significantly underperformed the broader index over the past five- and 10-year periods. Shares are only up 16% in the past decade, which is definitely not a great track record.

When did Warren Buffett buy GM stock

That's 0.43% of their equity portfolio (18th largest holding). The investor owns 2.79% of the outstanding General Motors Company stock. The first General Motors Company trade was made in Q1 2012. Since then Warren Buffett bought shares fourteen more times and sold shares on nine occasions.

Can a stock go to 0

The bottom line. The price of any stock can fall rapidly and even plummet to zero, usually when a company goes bankrupt. Whether this proves positive or negative depends on the position an investor holds. An investor in a long position can lose everything, while someone holding a short position can benefit greatly.

What happens if S&P 500 goes to zero

A stock price of zero, however, means that the expectation of future earnings is irrevocably lost, as would be the case for a company that dissolves and ceases to do business.

Is GM a safe stock

GM, currently trading just over $36 per share, has hit some potholes in recent years, even going into bankruptcy in 2009. But the company seems to be on the rebound, offers a strong dividend and has upside room for share price growth as it changes both its corporate culture and business model.

How high will GM stock go

Stock Price Forecast

The 20 analysts offering 12-month price forecasts for General Motors Co have a median target of 44.00, with a high estimate of 89.00 and a low estimate of 32.00. The median estimate represents a +12.04% increase from the last price of 39.27.

What happened to GM stockholders

And that's been the case for investors of the old General Motors, which filed for Chapter 11 reorganization on June 8, 2009. Common stock holders in the old General Motors were essentially wiped out, watching their shares morph into shares of Motors Liquidation.

What happened to GM shares in 2008

G.M. lost $30.9 billion, or $53.32 a share, in 2008 and spent $19.2 billion of its cash reserves. Mr. Wagoner met with President Obama's auto task force, and the company said that it could not survive much longer without additional government loans.

Can a stock go below 1

If a stock's share price drops below $1.00 and remains below that level for 30 days, the exchange may notify the company that it is not in compliance with listing requirements and is at risk of being delisted.

How often does the S&P 500 lose 10%

once every 2 years

This means, on average, the S&P 500 has experienced: a correction once every 2 years (10%+) a bear market once every 7 years (20%+) a crash once every 12 years (30%+)

Can the S&P 500 go to 0

And while theoretically possible, the entire US stock market going to zero would be incredibly unlikely. It would, in fact, take a catastrophic event involving the total dissolution of the US government and economic system for this to occur.

Should I invest in GM or Tesla

GM stands above TSLA thanks to its solid earnings outlook, and based on these valuation figures, we also feel that GM is the superior value option right now. To read this article on Zacks.com click here.

Is GM going 100% electric

GM is on its way to an all-electric future. We are aggressively going after every aspect of what it takes to put everyone in an EV because we need millions of EVs on the road to make a meaningful impact toward building a zero-emissions future.

Does Buffett still own GM stock

Although Buffett's company added just over 2 million shares to its position in GM during the first quarter of 2022, it ultimately sold close to 9.17 million shares in the June-ended quarter. On a net basis, Berkshire Hathaway has reduced its stake in GM by 7,122,641 shares since 2022 began.

Why has GM stock dropped so much

The drop comes after the company confirmed the departure of the executive who was the face of the company's transition to electric vehicles (EVs). It also didn't help investor confidence in the automaker when it said supply chain problems will keep its Mexican truck plant idle for longer than first planned.

How much did GM lose in 2008

Krueger in 2015. Both were top Obama-administration officials involved in the auto-bailout decision — Goolsbee had been a member of the Council of Economic Advisors and Krueger was chief economist at the Treasury Department. GM lost $40 billion in 2007 and another $31 billion in 2008, they pointed out.

Do stocks go below 0

The value of the stock itself can't go negative. It can only become zero is the company goes bankrupt. The only case when you can see negative result is if you bought the stock and the price declined.

Do most stocks go to 0

Technically, yes. You can lose all your money in stocks or any other investment that has some degree of risk. However, this is rare. Even if you only hold one stock that does very poorly, you'll usually retain some residual value.

Can the S&P 500 go to zero

And while theoretically possible, the entire US stock market going to zero would be incredibly unlikely. It would, in fact, take a catastrophic event involving the total dissolution of the US government and economic system for this to occur.

How often does a 20% market correction happen

about every

The average percent of market pullbacks and frequency are as follows: 5% or greater pullbacks occur about every 7 months. 10% or greater pullbacks occur about every 2 years. 20% or greater pullbacks occur about every 7 years.

Can S&P 500 go negative

According to Macrotrends.net, the S&P 500 has only seen consecutive years of negative returns three times since 1957, in 1973/1974 and in 2001/2002/2003 with returns getting worse in the second (and third) down year on each of those occasions.