What is a Class C stock

Class C shares are a class of mutual fund share characterized by a level load that includes annual charges for fund marketing, distribution, and servicing, set at a fixed percentage. These fees amount to a commission for the firm or individual helping the investor decide on which fund to own.

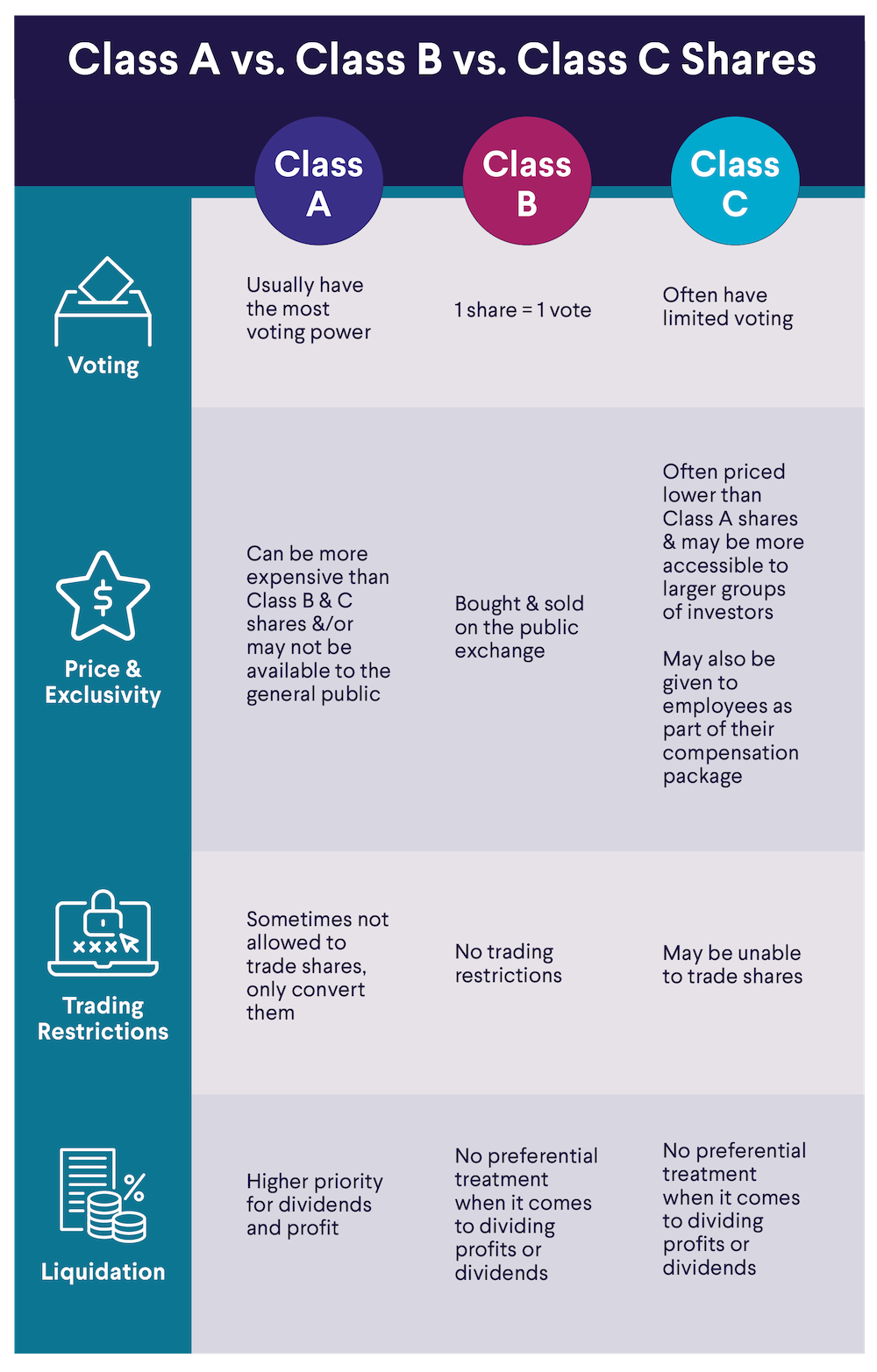

Are Class C shares voting

Because the Class C Capital Stock has no voting rights (except as required by law), the issuance of Class C Capital Stock will not result in voting dilution to the holders of shares of Class A Common Stock or Class B Common Stock.

What is the difference between B and C class shares

Sometimes three classes of shares are created with class 'A' having all the voting rights, class 'B' having all the dividend rights and class 'C' having all the capital rights. It is then possible for the different shareholders to have different percentages of the rights for these purposes.

What is the difference between Class A shares and Class C shares

Investors generally should consider Class A shares (the initial sales charge alternative) if they expect to hold the investment over the long term. Class C shares (the level sales charge alternative) should generally be considered for shorter-term holding periods.

Is it better to buy Class A or Class C stock

Alphabet Class A (GOOGL) vs Class C (GOOG): which to buy In summary, both GOOGL and GOOG give you equal ownership in Alphabet and have performed similarly in terms of their price history. However, GOOGL does confer voting rights while GOOG doesn't and hence the former tends to trade at a slightly higher price.

Are Class A or Class C stocks better

In this system, Class A shares are still premium shares with more voting rights, at least compared to Class C shares. However, Class B shares have the power that was traditionally associated with Class A shares. Investors should not assume that buying Class A shares makes them insiders or maximizes their voting power.

What is the benefit of Class C shares

Class C shares are level-load shares that don't impose a sales charge unless you sell too soon after your purchase (usually a period of a year). Instead, mutual funds charge an ongoing annual fee. C shares are probably best for short term investors of beyond one year and no more than three years.

Do Class C shares convert to A-shares

1. The conversion of Class C shares into Class A shares—which, prior to January 22, 2021, happens automatically approximately 10 years after purchase and, starting on or about January 22, 2021, happens automatically approximately 8 years after purchase—is not a taxable event for federal income tax purposes.

Can you sell Class C shares

Prior to February 7, 2011, certain Class C shares were subject to transfer restrictions. After such date, however, all Class C shares became eligible for public sale. There is no requirement that you sell your shares. If, however, you wish to sell your Class C shares, please review the information provided below.

Should I buy Google A or C

Alphabet Class A (GOOGL) vs Class C (GOOG): which to buy In summary, both GOOGL and GOOG give you equal ownership in Alphabet and have performed similarly in terms of their price history. However, GOOGL does confer voting rights while GOOG doesn't and hence the former tends to trade at a slightly higher price.

Why do companies issue C shares

According to the Association of Investment Companies (AIC), the advantage of C shares is that existing shareholders don't have to partake in the C share offer if they don't want to, they don't bear any of the issue costs, and they don't have their returns affected while they wait for the proceeds of the C share offer …

Will Google ever pay a dividend

The company said in its 2017 annual filing with the Securities and Exchange Commission that “we intend to retain any future earnings and do not expect to pay any cash dividends in the foreseeable future.”

Does Google stock pay dividends

Alphabet Class C (GOOG) does not pay a dividend.

What does C mean in shares

Class C shares are level-load shares that don't impose a sales charge unless you sell too soon after your purchase (usually a period of a year). Instead, mutual funds charge an ongoing annual fee. C shares are probably best for short term investors of beyond one year and no more than three years.

Are C shares cheaper than A-shares

Like Class B shares, Class C shares typically impose higher annual operating expenses than Class A shares due primarily to higher 12b-1 fees. Class C shares may be less expensive than Class A or B shares if you have a shorter-term investment horizon because you'll pay little or no sales charge.

Does Apple pay dividends

Electronic Technology stocks do not always pay a dividend but as Apple, Inc. pays dividends to reward its shareholders. In the quarter ending June 2023, Apple, Inc. has declared dividend of $0.24 – translating a dividend yield of 0.42%.

Has Netflix ever paid a dividend

Netflix (NFLX) does not pay a dividend.

Does Tesla stock pay dividends

Tesla (TSLA) does not pay a dividend.

What are the advantages of C shares

Class C shares are typically utilized by investors who are looking for corporate governance advantages, such as extra voting rights, discounts, and certain liquidation rights. They also offer a more accessible and cost-effective way to invest in the stock market.

Does Google pay a dividend

Dividend-Shy Google

Still other parts of Google are focused on entirely different markets, making the company something of a technological conglomerate. That being said, one of the biggest reasons why Google does not currently pay a dividend is that it wishes to continue its expansion into new ventures.

Is Coca Cola a dividend stock

How much is Coca-Cola's dividend KO pays a dividend of $0.46 per share. KO's annual dividend yield is 2.96%.

Is Google paying dividends

Many technology companies pay dividends, or regular cash distributions from earnings, to their shareholders. Alphabet (GOOGL), the parent company of Google, isn't one of them.

Should you buy Class A or C shares

Long-term investors (more than five years, at least, and preferably more than 10) will do best with class A share funds. Even though the front load may seem high, the ongoing, internal expenses of class A share funds tend to be lower than those of B and C shares.

Does Tesla pay dividend

TSLA does not currently pay a dividend.

Does Tesla pay dividends

The current TTM dividend payout for Tesla (TSLA) as of July 21, 2023 is $0.00. The current dividend yield for Tesla as of July 21, 2023 is 0.00%.