What is the 3 day rule in stocks

The three-day settlement rule states that a buyer, after purchasing a stock, must send payment to the brokerage firm within three business days after the trade date. The rule also requires the seller to provide the stocks within that time.

How can you tell if a stock will go up

Technical investors

If a stock is undervalued, it will likely go up. If a stock is overvalued, it will likely go down. Before you learn how to predict stock prices and how to predict the stock market in general, you need to determine which camp you're in.

Where is the bottom in stocks

A bottom is the lowest trading price for a security or index over a particular period of time. Stock market bottoms are usually identified in retrospect as the lowest point on the chart of a benchmark index like the S&P 500.

What does it mean if a stock bottoms out

If a stock has bottomed out, it means that it reached its low point and could be in the early stages of an upward trend. Often a bottom can be a signal for a reversal. Investors often see a bottom as an opportunity to purchase a stock when the security is underpriced or trading at its lowest value.

What is the 15 minute rule in stocks

Let the index/stock trade for the first fifteen minutes and then use the high and low of this “fifteen minute range” as support and resistance levels. A buy signal is given when price exceeds the high of the 15 minute range after an up gap.

What is the 1% day trading rule

Ideal position size will vary by strategy and portfolio size, but a good rule of thumb is you shouldn't risk much more or less than 1% of your portfolio on each trade.

Who is the most accurate stock predictor

Zacks has built a reputation as a reliable source of stock data for investors looking for a stock picking edge, Zacks' free stock screener has almost everything investors need to make well-timed and informed stock picks. That's why Zacks is our choice as the best free option for a stock screener.

Should I buy more stock when it goes up

The idea is to lean into your winners. Averaging up into a stock increases your average price per share. For example, say you buy XYZ at $20 per share, and as the stock rises you buy equal amounts at $24, $28, and $32 per share. This would bring your average purchase price, or cost- basis, to $26 per share.

Has S&P 500 bottomed out

“The S&P 500 has never bottomed before the start of a recession, but it's not clear yet whether the US economy will actually fall into a downturn,” said Ed Clissold, chief US strategist at Ned Davis Research, whose firm forecasts a 75% chance that the US will slump into an economic slowdown in the first half of 2023.

How long does it take for stocks to bottom

Stocks peak about six months (26 weeks) ahead of the start of the recession. Stocks bottom about a year after the recession starts. After bottoming, stocks take about 3.5 years to return to near their prior peak.

How long does it take for the stock market to bottom

On average, it's taken 473 calendar days for the S&P 500 to reach its bottom once the nation's central bank begins easing. If the current bear market were to follow previous cycles, a bottom would be expected within the next four months.

What is 20% stock rule

In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.

What is the 11 o’clock rule in stocks

The Rule goes something like this. If the market has not reversed by 11am (Chicago time, CST) then it's unlikely to be a Reversal day. Don't expect any strong moves against the morning trend direction.

What is the 2% rule in day trading

One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.

Is making 1% a day trading good

Making 1% a day in the markets, unfortunately, isn't a realistic goal. That's not too strange, considering that returns of that kind easily would add up to yearly returns of 1000% or more. A more realistic view of what a high performing trader might make per day on average, is somewhere around 0.15% a day.

Who is the most respected stock analyst

And on Wall Street, right now Jeffries analyst Mark Lipacis is the best of the lot. According to TipRanks, a platform that tracks and measures the performance of anyone giving financial advice online, over the past year, 72% of Lipacis' recommendations have been successful.

Who is the most successful stock analyst

Out of more than 8,000 total analysts in the TipRanks database, Jefferies analyst Mark Lipacis is rated No. 1 based on his stock-picking track record over the past 10 years. Lipacis has an impressive 73% success rate on his stock ratings, and his 498 stock picks generated an average return of 30.3%.

How long should you hold a losing stock

According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price, no exceptions. Having a rule in place ahead of time can help prevent an emotional decision to hang on too long.

What happens if my stock hits zero

If a stock falls to or close to zero, it means that the company is effectively bankrupt and has no value to shareholders. “A company typically goes to zero when it becomes bankrupt or is technically insolvent, such as Silicon Valley Bank,” says Darren Sissons, partner and portfolio manager at Campbell, Lee & Ross.

Can the S&P 500 go to 0

And while theoretically possible, the entire US stock market going to zero would be incredibly unlikely. It would, in fact, take a catastrophic event involving the total dissolution of the US government and economic system for this to occur.

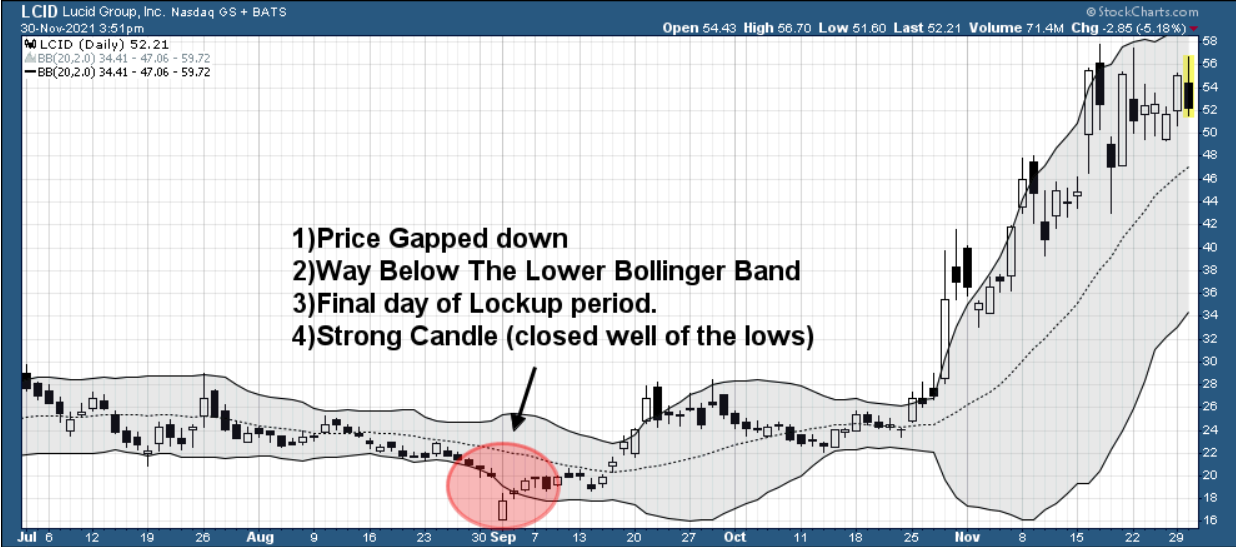

What is the best indicator of the market bottom

Price and volume are key tools for identifying market bottoms and peaks. When using volume in a downtrend, it's important to look at the downtrend at certain intervals to see how it fits the bottoming scenario. Two key methods for finding volumes involve looking at volume histograms and on balance volume (OBV).

Can a stock go below 1

If a stock's share price drops below $1.00 and remains below that level for 30 days, the exchange may notify the company that it is not in compliance with listing requirements and is at risk of being delisted.

Do all stocks eventually go to zero

Have any stock markets gone to zero before The answer is yes, although under extraordinary circumstances. Globally, only a few markets have suffered total market loss. The largest and most well known markets that went to zero are Russia in 1917 and China in 1949.

How long can a stock be below 1

The NYSE's rules state that a stock can trade below the value of one dollar for a consecutive period of 29 days. On Day 30, the company is required to sell its shares for US$ 1 or more per piece.

What is the 7% rule in stocks

To make money in stocks, you must protect the money you have. Live to invest another day by following this simple rule: Always sell a stock it if falls 7%-8% below what you paid for it. No questions asked. This basic principle helps you cap your potential downside.