How many days in a year to trade

252 trading days

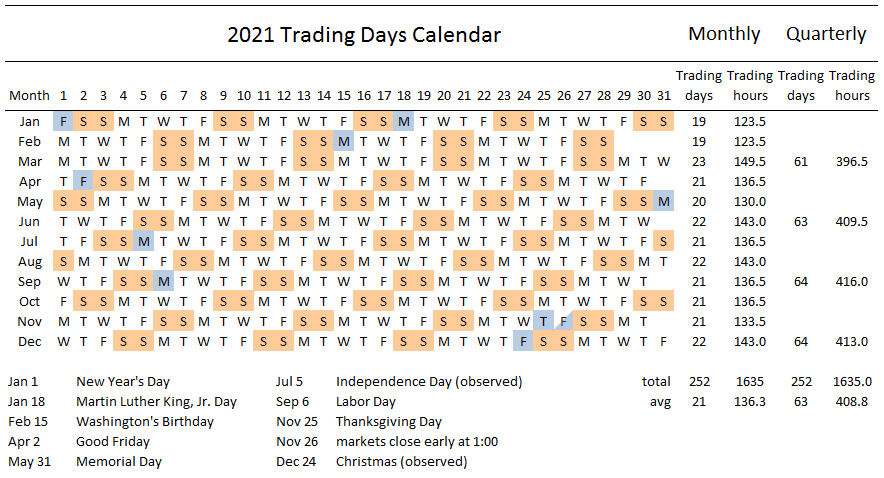

2021. There are exactly 252 trading days in 2021. January and February have the fewest (19), and March the most (23), with an average of 21 per month, or 63 per quarter. Out of a possible 365 days, 104 days are weekend days (Saturday and Sunday) when the stock exchanges are closed.

How many trading days left in the year 2023

As you can see, at the close of trading on Friday, November 24, there are 4 trading days (or 26 trading hours) left in November, and 24 trading days (or 156 trading hours) left in 2023.

How many trading days in a month

For the U.S. stock market, the number of trading days in a month is 21 days on average, but the number varies from month to month. For example, in 2021, January and February have 19 trading days, while March has 23 trading days, which is the most for any month.

How many trading days in a year for the NYSE

There are usually 252 trading days in a year on the NYSE, but, again, these depend on how many weekend days are in a certain year. The Nasdaq average number of trading days in a year is also the same since both stock markets follow the same national holiday calendar.

How many hours a day trader

As a result, day traders typically work more than an average of eight hours. If you work as an independent day trader, this is also common. Depending on your position, you may not have an opportunity to take much time off from work, except for the weekends and holidays when the markets are closed.

How long do traders trade for

The right answer to this is that it depends on the type of trader and the strategy they use. Many part-time traders tend to spend less than one hour trading. On the other hand, full-time traders tend to spend more time trading on a daily basis (between two and five hours).

How many trading days are in 2024

Number of Trading Days In 2023 In the United States (NYSE)

| 🕖 Month | 📆 Trading Days 2023 | 📆 Trading Days 2024 |

|---|---|---|

| Oct | 22 | 23 |

| Nov | 21 | 20 |

| Dez | 20 (63qtr) | 21 (64qtr) |

| Total | 250 | 252 |

How often do day traders lose

64% of all US day traders lose money, and only 36% realize profits. Active day traders in the US underperform a value-weighted index by 10.3% annually.

Can you make $1000 a month day trading

Despite being able to make $1,000 or $5,000—depending on starting account size—over and over again, most day traders end up being like a recreational fisherman who catches a fish but then throws it back.

How long do traders trade a day

Hours day traders work

The right answer to this is that it depends on the type of trader and the strategy they use. Many part-time traders tend to spend less than one hour trading. On the other hand, full-time traders tend to spend more time trading on a daily basis (between two and five hours).

How often do day traders beat the market

Approximately 1-20% of day traders make money day trading. Just a tiny fraction of day traders make any significant amount of money. That means that between 80 to 99% of them fail. We have looked at plenty of research and very few traders can brag about making any significant amount of money day trading.

How many days does stock market work

Trading on the derivatives segment takes place on all days of the week (except Saturdays and Sundays and holidays declared by the Exchange in advance). The market timings of the derivatives segment are: Normal market / Exercise market open time: 09:15 hrs. Normal market close time: 15:30 hrs.

Can I live off day trading

While some can make a living trading stocks, the majority of day traders lose money over the long term. Education is critical to being a successful trader. You should also develop a trading strategy and stick to it.

Do professional traders trade daily

This typically means that most professional traders are not day trading or scalping, instead they are focused on multi-day positions and look to take a good slice of the action that takes place in the market each week or month.

Is trading like gambling

The main difference between day trading and gambling is that gamblers play available odds while traders strategize based on market trends, price movements, and past performances. Traders often use sophisticated analytical tools and real-time market updates to decide which stocks to buy or sell and how much to spend.

Are there 250 or 252 trading days

Understanding trading days involves regular and extended trading hours of the NYSE, with typically 252 total days in a year. Weekends and stock market holidays can reduce this number, while leap years or special circumstances may increase it.

How many days is the stock market open 2023

Regular operating hours for both exchanges are Monday-Friday from 9:30 a.m. – 4 p.m. ET. Markets do not operate during the weekend.

Why do 90% of day traders fail

Lack of Risk Management

This can include setting stop-loss orders to limit losses, diversifying your positions to spread risk, and avoiding risky trades beyond your position sizing limits. Unfortunately, many traders fail to implement a solid risk management plan and take on more risk than they can handle.

Why 95% of traders lose money

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices. First, investors need a guidebook/mentor/course to help or guide them in daily trading.

Why $25 000 for day trading

One of the most common requirements for trading the stock market as a day trader is the $25,000 rule. You need a minimum of $25,000 equity to day trade a margin account because the Financial Industry Regulatory Authority (FINRA) mandates it. The regulatory body calls it the 'Pattern Day Trading Rule'.

Is it easy to make $100 day day trading

It is possible to make $100 a day through day trading with enough starting capital and successful trades, but again, day trading is high risk, so you may lose that money instead.

Why 95% of day traders lose money

Another reason why day traders tend to lose money is that it's very different from long-term investing. While traders take advantage of price swings (which means they have to make specific predictions), investors tend to buy a diversified basket of assets for the long haul.

How many days is a trading week

4.85 trading days

Well, technically there are 252 trading days out of a possible 365 in any given year in the U.S. stock market, which breaks down into about 4.85 trading days a week.

How many trading weeks in a year

There are 52 trading weeks in a year, just as there are 52 weeks in a year because the markets rarely, if ever, close for a full week without opening for business. However, in some trading weeks, the market may not be open for the entire five weekdays.

Is it possible to make $100 a day day trading

You're really probably going to need closer to 4,000 or $5,000 in order to make that $100 a day consistently. And ultimately it's going to be a couple of trades a week where you total $500 a week, so it's going to take a little bit more work. Want to learn more about trading