Will US stock market recover

In a nutshell, nobody knows when the stock market will recover and start reaching new all-time highs. It could happen in a year or so if things go very well economically, or it could take several years. After the dot-com crash, it took some solid companies a long time to get back to where they were.

Is the US stock market safe

Over the long term, the market is incredibly safe. But it's still up to you to choose the right investments. If you're investing in unsafe stocks, your portfolio may not survive a downturn — even if the market as a whole thrives.

How reliable is the stock market

The performances of individual stocks vary widely over time, but taken as a whole the stock market has historically rewarded investors with average annual returns of around 10%, making it one of the most reliable ways of growing your money.

Is it good to invest in US stock market

Diversification. Investing in the US markets helps you diversify your portfolio as the market offers extensive avenues to invest in top sectors of Technology, Finance, Automobile and Gold. Investing a part of your assets in such markets also makes you independent of the Indian stock markets and the Indian economy.

Will US stock market recover in 2023

The S&P 500 (. SPX) is up 15.9% in 2023 – a rebound that surprised many analysts after equities' brutal 2022 decline. The tech-heavy Nasdaq Composite (. IXIC) has gained 31.7%, its best first half in 40 years.

What happens if US stock market crashes

Stock market crashes wipe out equity-investment values and are most harmful to those who rely on investment returns for retirement. Although the collapse of equity prices can occur over a day or a year, crashes are often followed by a recession or depression.

When was the last time the US stock market crashed

March 9, 2020

The most recent stock market crash began on March 9, 2020. Other famous stock market crashes were in 1929, 1987, 1997, 2000, 2008, 2015, and 2018.

Has anyone beat the stock market

The phrase "beating the market" means earning an investment return that exceeds the performance of the Standard & Poor's 500 index. Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

Is the stock market safe long term

Long-term investing FAQs

If you're taking a long-term perspective on the stock market and are properly diversifying your portfolio, it's almost always a good time to invest. That's because the market tends to go up over time, and time in the market is more important than timing the market, as the old saying goes.

Will the stock market recover in 2024

U.S. strategists expect a meaningful earnings recession of -16% for 2023 and a significant recovery in 2024. Strategists expect falling inflation could hurt margins and that investors are overly optimistic about the positive impact of AI.

Which country stock market is best to invest

What are the five best performing stock markets since 1900The Australian Stock Market.The U.S. Stock Market.The South African Stock Market.The New Zealand Stock Market.The Denmark Stock Market.The possibility of earning significant returns.The ability to safeguard your wealth against inflation.

Is US stock market overpriced

Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 72% to 127%, depending on the indicator, up from last month's 65% to 117%. We've plotted the S&P regression data as an area chart type rather than a line to make the comparisons a bit easier to read.

Should I pull my money out of the stock market

Key Takeaways. While holding or moving to cash might feel good mentally and help avoid short-term stock market volatility, it is unlikely to be wise over the long term. Once you cash out a stock that's dropped in price, you move from a paper loss to an actual loss.

Do I lose all my money if the market crashes

No, a stock market crash only indicates a fall in prices where a majority of investors face losses but do not completely lose all the money. The money is lost only when the positions are sold during or after the crash.

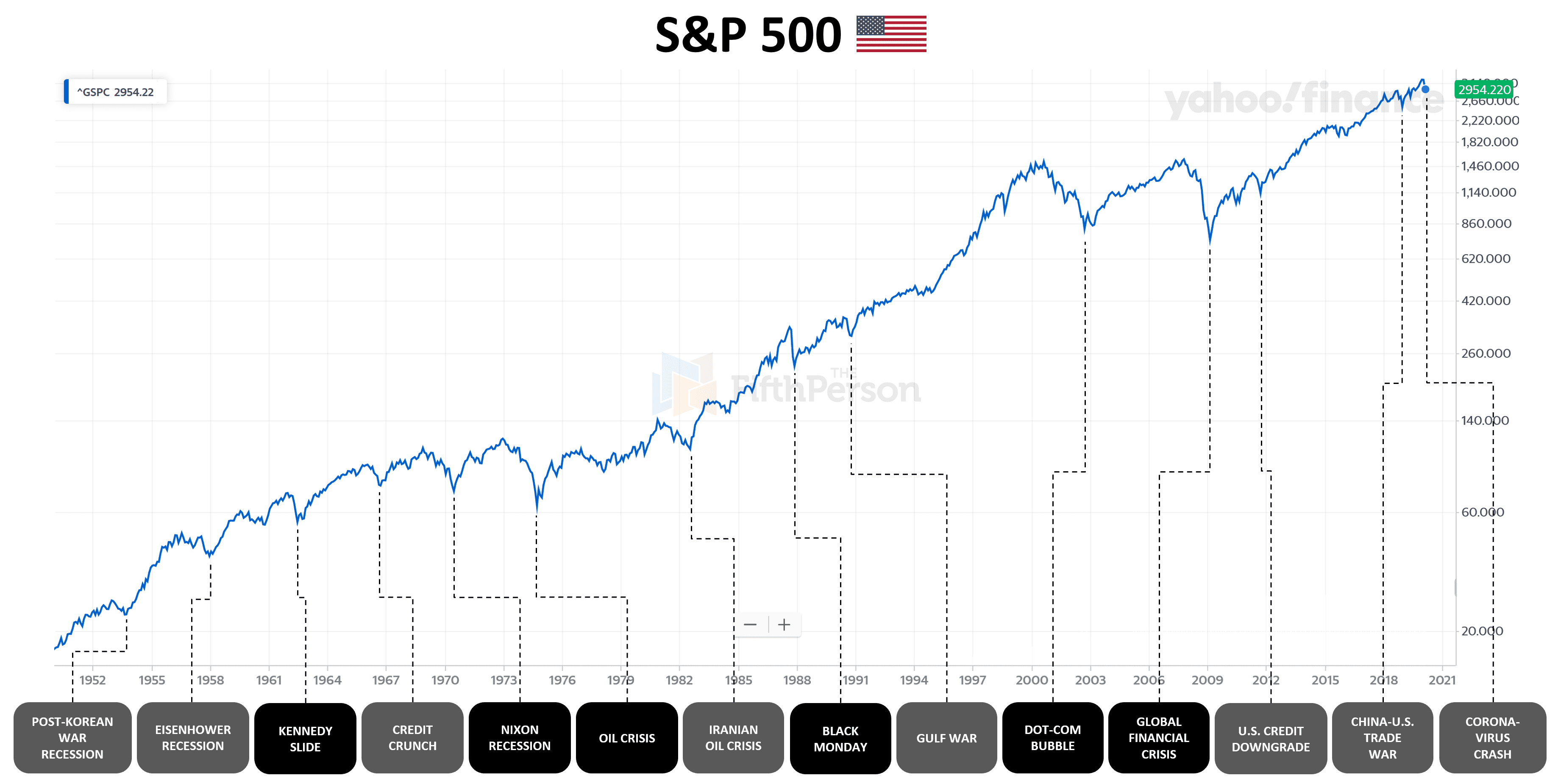

How often does the US market crash

This means, on average, the S&P 500 has experienced: a correction once every 2 years (10%+) a bear market once every 7 years (20%+) a crash once every 12 years (30%+)

Has the US stock market ever shut down

Following conflicts that began in June 1914, the NYSE closed due to the pending world war. The NYSE closed on July 30, 1914 and did not re-open until December 12, 1914. On the final day of trading, the Dow was down 6.90%. The bond markets re-opened in November, but stocks could not be traded until December 12.

Why do 90% of people lose money in the stock market

One of the biggest reasons traders lose money is a lack of knowledge and education. Many people are drawn to trading because they believe it's a way to make quick money without investing much time or effort. However, this is a dangerous misconception that often leads to losses.

Is it possible to beat the S&P 500

The majority managers seeking to outperform the S&P 500 fail. However, there is a way to improve the odds tremendously. Almost every institutional investor would like to find an investment manager with a high probability of outperforming the S&P 500.

How many years will it take for the stock market to recover

So when will stocks fully recover from the bear market Many experts appear optimistic it will happen in 2023.

Will US market recover in 2023

In conclusion, the stock market may recover in 2023, but there are also risks and uncertainties that could continue to impact investor sentiment. As an investor, it's important to stay disciplined, focus on high-quality companies, and maintain a long-term perspective when making investment decisions.

Which country is the safest to invest in

Here are the Best Countries to Invest In in 2022United States.Japan.South Korea.Singapore.China.Germany.

Which country has the most stable stock market

The top ten best performing stock markets in the world since 1900 include the following countries: Australia, the United States, South Africa, New Zealand, Denmark, Sweden, Canada, Finland, Switzerland, and the Netherlands.

Why did US stocks fall

US stocks fell on Monday as investors weighed whether the US central bank might pause rate hikes after growth slowed in the services sector.

Is the S&P 500 overvalued

The consensus among private investors is that US equities, specifically the S&P 500 index, are overvalued. But the earnings-based measures used to judge their valuation can be flawed. Other measures suggest that US equities are trading around fair value and that shorting US large-cap companies might not be advisable.

What will stock market do in 2023

Stock Market Performance In 2023

U.S. stock market gains in the first half of 2023 have been rosier than some entire years in the past. This alone raises the risk for a spill in prices. The S&P 500's rise in 2023 reached almost 16% in mid-June.