Is a flag bullish or bearish

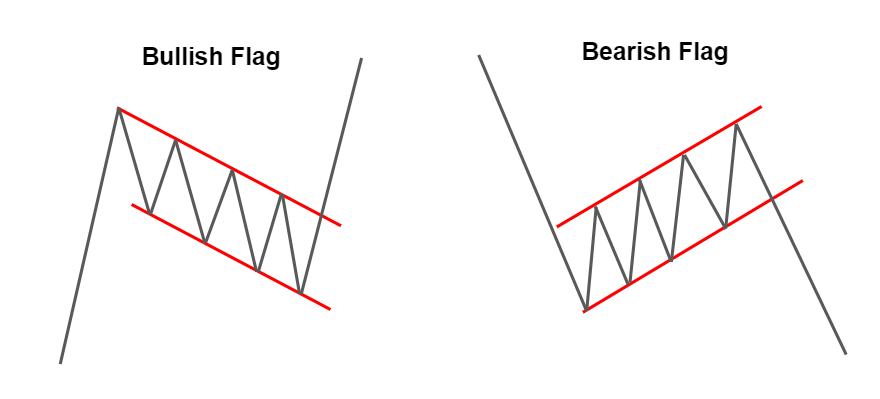

The pattern typically consists of between five and twenty price bars. Flag patterns can be either upward trending (bullish flag) or downward trending (bearish flag). The bottom of the flag should not exceed the midpoint of the flagpole that preceded it.

What happens after a flag pattern

Breakout. The breakout is where you will take your trade when using the flag pattern. After this period of consolidation and the formation of a clear price channel, the market will inevitably break out to either side.

Is a rising flag pattern bullish or bearish

One such pattern is the Rising Flag, also known as the Bullish Flag, which signifies a temporary pause in an upward price trend followed by a continuation of the previous bullish momentum.

What is bullish flag pattern

A bull flag is a bullish chart pattern formed by two rallies separated by a brief consolidating retracement period. The flagpole forms on an almost vertical price spike as sellers get blindsided from the buyers, then a pullback that has parallel upper and lower trendlines, which form the flag.

How reliable is flag pattern

A flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. Although it is less popular than triangles and wedges, traders consider flags to be extremely reliable chart patterns.

What happens after bull flag pattern

The bull flag pattern is thought to suggest an uptrend: that when the price of the stock leaves the area between the 2 lines, it will continue upwards. This makes it a continuation pattern, which is a pattern that is thought to suggest that the price will continue to move in the same direction.

Is a bull flag pattern bullish

The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. As the name itself suggests, a bull flag is a bullish pattern, unlike the bear flag that takes place in the middle of a downtrend.

What is the flag pattern rule

A flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. The flag portion of the pattern must run between parallel lines and can either be slanted up, down, or even sideways. Enter a trade when the prices break above or below the upper or lower trendline of the flag.

Is a bull flag pattern good

The bull flag pattern is thought to suggest an uptrend: that when the price of the stock leaves the area between the 2 lines, it will continue upwards. This makes it a continuation pattern, which is a pattern that is thought to suggest that the price will continue to move in the same direction.

Which trading pattern is most accurate

head and shoulder bottom pattern

The head and shoulder bottom pattern is proven to be the most successful chart pattern in a bull market, with an 88 percent accuracy rate and an average price change of +50 percent. Other successful patterns include the double bottom (88 percent) and the ascending triangle (83 percent).

What shape is best for a flag

Choose the right shape

Standard flags usually have a standard curve, standard rectangle, or standard slice shape. TIP: The “slice” shape is more angular and might be a good choice for a more aggressive part of your show.

Is a bull flag good or bad

A high-tight bull flag pattern is a good signal for traders. It provides an easy and accurate way to identify potential buying opportunities creating high-probability trades.

How do you read a flag pattern

The flagpole in the pattern. And is followed by a pullback that creates diagonal support and resistance levels. These diagonal levels create the patterns flag typically.

How do you trade in flag patterns

And to trade a flag pattern you can enter when the market break above the highs with stop loss one ATR below the low. If you want to exit your winners or maybe it may be a winning or losing trade, but if you do not trail your stops you can consider using a moving average.

Which chart pattern is most bullish

An ascending triangle is a continuation pattern marking a trend with a specific entry point, profit target, and stop loss level. The resistance line intersects the breakout line, pointing out the entry point. The ascending triangle is a bullish trading pattern.

What is the most reliable bullish pattern

The five most popular bullish candlestick patternsThe Bullish Hammer. The Bullish Hammer is one of the most popular patterns.The Bullish Engulfing. The Bullish Engulfing is a two-candle pattern.The Bullish Inverted Hammer.The Bullish Morning Star.The Bullish Three White Soldiers.

What is the best flag proportion

The standard American flag dimensions should be between one-quarter and one-third the height of the flagpole. Using the one-quarter rule, you would need a 3 ft. by 5 ft. flag size for a 20 ft.

Is it OK to frame a flag

If you have the wall space to display the flag in its entirety, you will need a much larger case or frame to protect it. You can present an unfurled flag by hanging it in a Shadow-Box, or pressed between glass and the backing in a traditional frame.

How do you use flag patterns

A Flag pattern is a weak pullback of an existing trend, usually shown in a form of small-bodied candles. The best time to trade the flag pattern is after the breakout or during a strong trending market. And to trade a flag pattern you can enter when the market break above the highs with stop loss one ATR below the low.

What is the success rate of the flag pattern

The Loose Bull Flag Fails, But the High-Tight Flag is a Proven Winner. According to an analysis of 1,028 trades, only one bull flag pattern has a success rate of 85%, while the rest have a failure rate of 55%. The high-tight bull flag is the only flag pattern you should trade.

How accurate are bull flags

It's not an exact science, but it's about as close to predictable as the stock market gets. The bull flag pattern and its variations are one of the most common and reliable. Will the bull flag setup work 100% of the time Of course not.

What is the most bullish indicator

Here are five examples of bullish indicators and bullish patterns.RSI Weakness. The Relative Strength Index (RSI) is a technical indicator that gives investors an idea of how overvalued or undervalued a security might be.Cup-and-Handle Pattern.Moving Average Golden Cross.Bollinger Bands Width.Piercing Pattern.

How do you know if a chart is bullish

Bullish: An Upside Breakout occurs when the price breaks out through the top of a trading range marked by horizontal boundary lines across the highs and lows. This bullish pattern indicates that prices may rise explosively over a period of days or weeks as a sharp uptrend appears.

How reliable is a bull flag pattern

How reliable is a bull flag pattern The high-tight bull flag pattern is a reliable chart indicator, with success rates of 85 percent during a bull market.

Do flags follow the golden ratio

The only country whose flag has an aspect ratio equal to the golden ratio is Togo.