Is it good idea to invest in stocks

Stocks offer investors the greatest potential for growth (capital appreciation) over the long haul. Investors willing to stick with stocks over long periods of time, say 15 years, generally have been rewarded with strong, positive returns.

Is it smart to put all your money in stocks

As a young person, you might decide to invest all of your money in stocks due to the higher returns. Your portfolio will be more volatile, but overall you should see a greater return in the long run. Then as you get older, you can diversify and allocate some of your money into bonds or other investments.

Is it worth investing $100 in the stock market

The main argument advanced by proponents of a 100% equities strategy is simple and straightforward: In the long run, equities outperform bonds and cash; therefore, allocating your entire portfolio to stocks will maximize your returns.

Should I invest or save money

It's a good rule of thumb to prioritize saving over investing if you don't have an emergency fund or if you'll need the cash within the next few years. If there are funds you won't need for at least five years, that money may be a good candidate for investing.

What is a disadvantage of owning stock

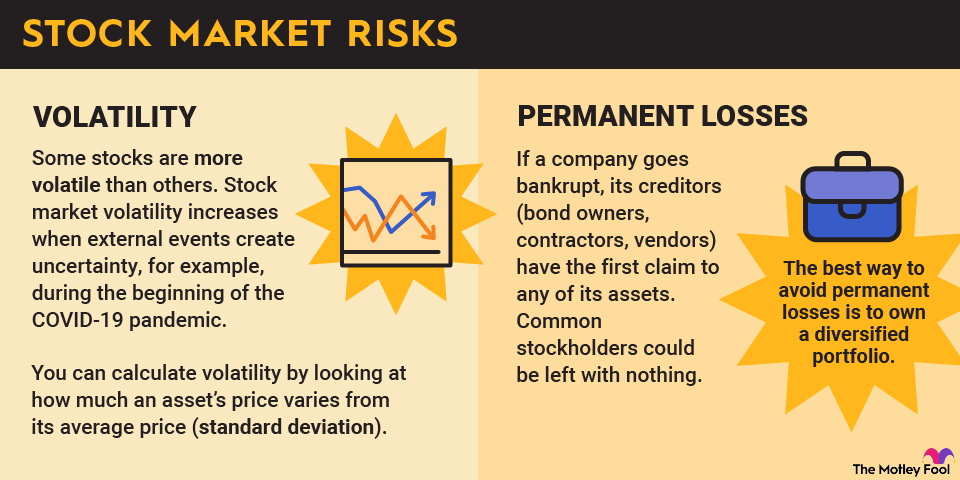

Disadvantages of investing in stocks Stocks have some distinct disadvantages of which individual investors should be aware: • Stock prices are risky and volatile. Prices can be erratic, rising and declining quickly, often in relation to companies' policies, which individual investors do not influence.

Is 100% stocks too risky

In any given decade, stocks can and do crash.

If you have no more than a decade to plan for, you certainly wouldn't invest 100% of your money in stocks. But when you're under 40, you have several decades before retirement. That's long enough to take advantage of the long-term trend in stocks.

Is it better to save or invest

Is it better to save or invest It's a good rule of thumb to prioritize saving over investing if you don't have an emergency fund or if you'll need the cash within the next few years. If there are funds you won't need for at least five years, that money may be a good candidate for investing.

Is investing $50 a month worth it

You might say, “That's great and all, but what's $50 a month really going to do in the end” The answer: A lot. The power of compounding interest cannot be understated. The more time you allow your investment to grow without making a withdrawal, the more this effect can be seen.

Should I save or invest in my 20s

Your 20s can be a great time to take on investment risk because you have a long time to make up for losses. Focusing on riskier assets, such as stocks, for long-term goals will likely make a lot of sense when you're in a position to start early.

Why investing is better than saving

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

Who shouldn’t invest in stocks

If you have debt, especially credit card debt, or really any other personal debt that has a higher interest rate. You should not invest, because you will get a better return by merely paying debt down due to the amount of interest that you're paying.

Is it risky to own a stock

Investment Products

But there are no guarantees of profits when you buy stock, which makes stock one of the most risky investments. If a company doesn't do well or falls out of favor with investors, its stock can fall in price, and investors could lose money.

Are stocks a bad idea

But there are no guarantees of profits when you buy stock, which makes stock one of the most risky investments. If a company doesn't do well or falls out of favor with investors, its stock can fall in price, and investors could lose money. You can make money in two ways from owning stock.

Should I invest 10k in stocks

$10,000 is an excellent amount to start investing in individual companies. For example, you could buy $1,000 of stock in 10 companies or $500 of stock in 20 companies. However, self-directed investing requires you to do your research to make informed decisions.

Will I lose more money than I invest

The short answer is yes, you can lose more than you invest in stocks. However, it depends on the type of account you have and the trading you do. Although you cannot lose more than you invest with a cash account, you can potentially lose more than you invest with a margin account.

What if I invest $200 a month for 20 years

Many retirement planners suggest using a more modest annual return of 6% when forecasting the long-term performance of a portfolio. At 6%, after 20 years the $200-a-month portfolio would be worth $93,070.

Is $100 a month enough to invest

Investing $100 a month gives you the chance to make regular progress toward your financial goals. Sticking to a regular commitment can help you build wealth over time. If you are ready to invest $100 a month, your returns will vary based on your investment choices.

Is 21 too late to invest

No matter how old you are, the best time to start investing was a while ago. But it's never too late to do something. Just make sure the decisions you make are the right ones for your age—your investment approach should age with you.

Is 21 too late to start investing

No matter your age, there is never a wrong time to start investing. Let's take a look at three hypothetical examples below. For these examples, everyone invests $57.69/week with a 7% growth rate and has an annual salary of $30,000. Ashley started contributing early at 21 but stops at age 35.

Are stocks better than savings

Investing products such as stocks can have much higher returns than savings accounts and CDs. Over time, the Standard & Poor's 500 stock index (S&P 500), has returned about 10 percent annually, though the return can fluctuate greatly in any given year. Investing products are generally very liquid.

Should you save money or invest

A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you grow money over the long term, making it a strong option for funding expensive future goals, like retirement.

Are stocks a bad investment

Over many decades, the investment that has provided the highest average rate of return has been stocks. But there are no guarantees of profits when you buy stock, which makes stock one of the most risky investments.

Are stocks safer than cash

Investors who need funds for emergencies or are saving for high-ticket purchases will want to invest more in cash. Investors with greater risk tolerance and longer-term horizons for investing can put more money toward stocks.

Why don’t people invest in stocks

For some, it's a fear of taking losses. For others, it's feeling they don't know how and/or that they don't have enough resources to invest. Unfortunately, it appears there is a misconception out there that you need to be an expert with a lot of money to start investing.

Why not to invest in stocks

Investing exclusively in stocks may cause you to lose a significant amount of money if the market crashes. To hedge against losses, investors strategically make other investments to spread out their exposure and reduce their risk.