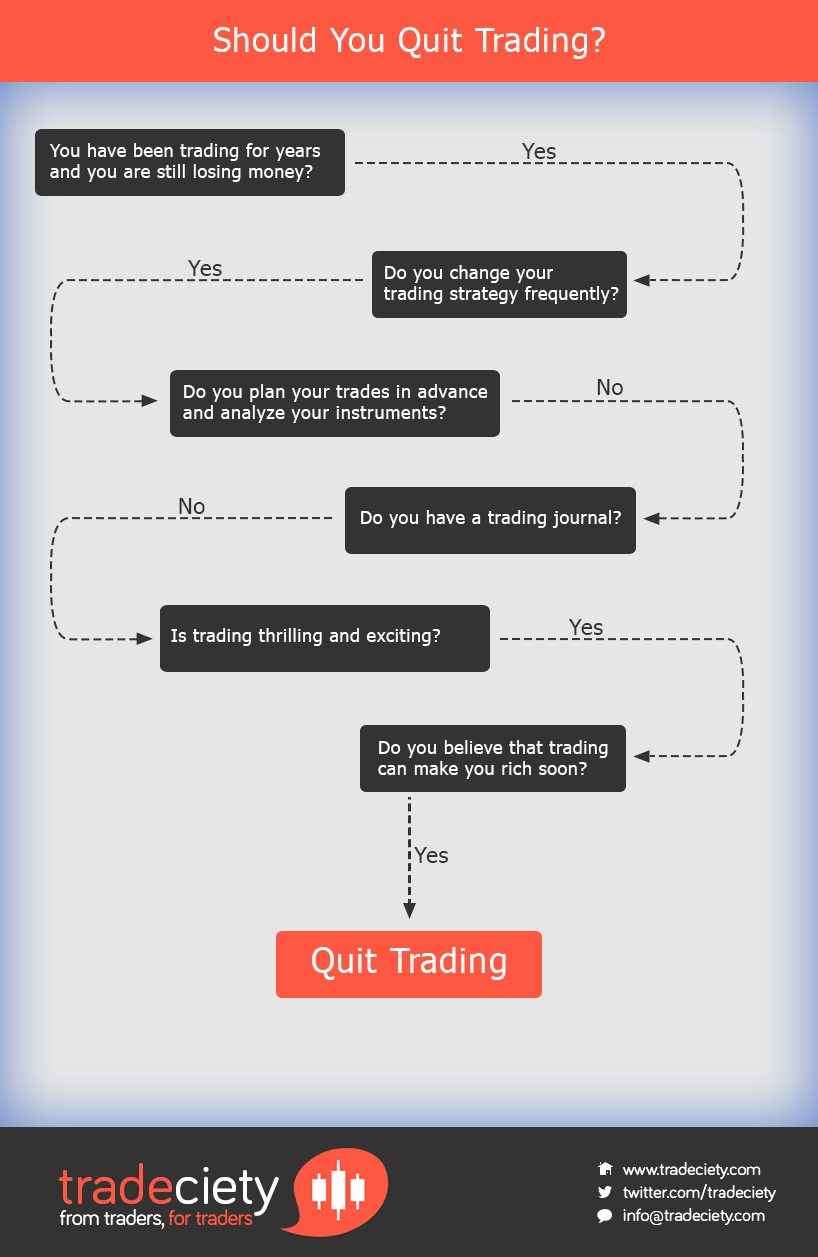

When you should stop trading

If you have no more mental capital left

But when you lose all your mental capital, maybe you have busted a few trading accounts, maybe you've been trading for years but your results are getting nowhere and you're getting tired, your mental capital is depleted, this is the time to quit trading.

What percent of traders quit

40% of day traders quit within a month, and 87% quit within 3 years. Most day traders are unable to sustain their trading activity over the long term, with a high percentage quitting within a short period of time.

How many traders quit

It is estimated that more than 80% of traders fail and quit. One key to success is to identify strategies that win more money than they lose. Many traders fail because strategies fail to adapt to changing market conditions. Classic rules from pro traders can help keep a sharp focus on profitability.

Is it true that 90 of traders lose money

It sounds easy, but the data shows the opposite is true: The vast majority of traders end up losing money over time. A report from the investment platform eToro suggests that 80% of its users lost money over a 12-month period.

Why do most traders quit

Lack of knowledge

This single biggest reason why most traders fail to make money when trading the stock market is due to a lack of knowledge. We can also put poor education into this arena because while many seek to educate themselves, they look in all the wrong places and, therefore, end up gaining a poor education.

Why do 90 of traders fail

Most new traders lose because they can't control the actions their emotions cause them to make. Another common mistake that traders make is a lack of risk management. Trading involves risk, and it's essential to have a plan in place for how you will manage that risk.

Why 95% of traders fail

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices. First, investors need a guidebook/mentor/course to help or guide them in daily trading.

Do 97% of traders lose money

On any given day, 97% of day traders lose money net of trading fees. This data suggests that new investors decide to begin day trading only because they are overconfident in their ability to be profitable at it.

Why 95% of traders lose

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices. First, investors need a guidebook/mentor/course to help or guide them in daily trading.

Why do 90% of day traders fail

Lack of Risk Management

This can include setting stop-loss orders to limit losses, diversifying your positions to spread risk, and avoiding risky trades beyond your position sizing limits. Unfortunately, many traders fail to implement a solid risk management plan and take on more risk than they can handle.

Do 78% of day traders lose money

A study of eToro day traders found nearly 80% of them had lost money over a 12-month period, and the median loss was 36%.

Why 90% of traders fail

Most new traders lose because they can't control the actions their emotions cause them to make. Another common mistake that traders make is a lack of risk management. Trading involves risk, and it's essential to have a plan in place for how you will manage that risk.

Why 99% of traders lose money

Over trading is a scenario where one tries to take too many trades in a single day. Traders want to take advantage of every dip and fall. This is a psychological trait that people don't want to lose. And in order to recover those previous losses, young traders take another shot to break even.

Why 95% of traders lose money

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices. First, investors need a guidebook/mentor/course to help or guide them in daily trading.