What are leading indicators vs lagging indicators examples

Leading indicators look forward, through the windshield, at the road ahead. Lagging indicators look backwards, through the rear window, at the road you've already traveled. A financial indicator like revenue, for example, is a lagging indicator. It tells you what has already happened.

What is an example of a leading indicator

Leading indicator examples include the Consumer Confidence Index, Purchasing Managers' Index, initial jobless claims, and average hours worked. Lagging indicators are metrics that can confirm change rather than predict it.

What is an example of a lagging indicator

Moving Averages, MACD, and Bollinger Bands are three types of lagging indicators. They cannot predict the future as the lagging indicators shift only upon major economic events.

What is the difference between leading vs lagging KPI indicators

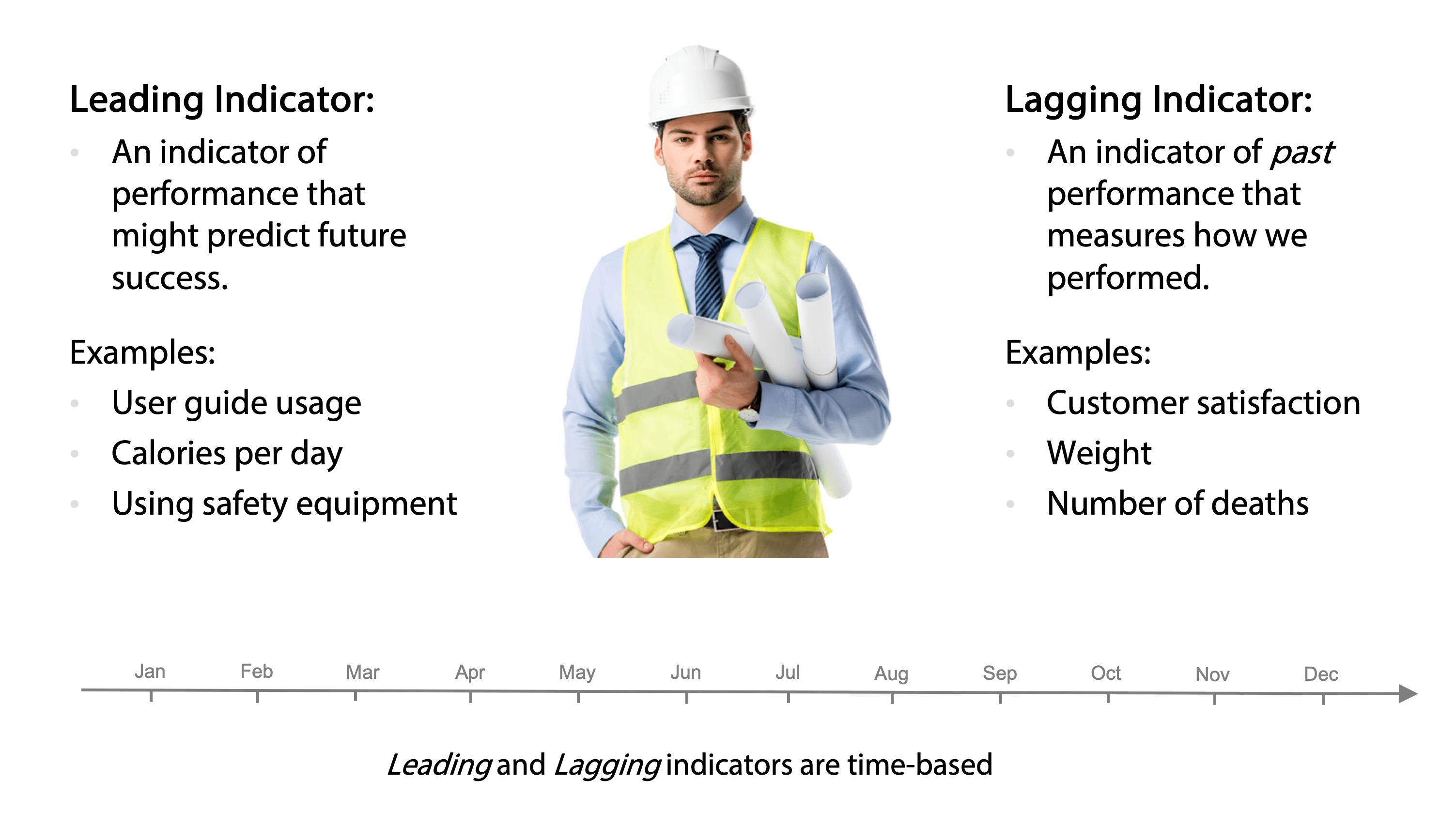

These KPIs, such as the number of enquiries, help predict future sales and give you the ability to plan and make strategic decisions. The key difference between Leading and Lagging KPIs is that Leading KPIs indicate where you're likely to go, while Lagging KPIs only measure what you have already achieved.

What is leading KPI and lagging KPI

Lagging indicators take a long time to change and show the later-stage results of efforts. Leading indicators, on the other hand, measure the activities you think will help you reach your goal, and can be tracked on a more ongoing basis.

Is inflation a lagging indicator

Is Inflation a Lagging Indicator Yes, inflation can be considered a lagging indicator. Inflation is defined as a period of rising prices, and when prices go up, people can't afford as much as they used to; therefore, inflation is also a period of declining purchasing power.

What are the 10 leading indicators

The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers' new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers' new orders for nondefense capital …

Is KPI a leading indicator

A leading KPI indicator is a measurable factor that changes before the company starts to follow a particular pattern or trend. Leading KPIs are used to predict changes in the company, but they are not always accurate.

What is the best leading indicator

Four popular leading indicatorsThe relative strength index (RSI)The stochastic oscillator.Williams %R.On-balance volume (OBV)

What is the best lagging indicator

A disadvantage of lagging indicators is that they put you in the trade fairly late. This means that you will typically miss a relatively big part of the price move. Popular lagging indicators are Moving Averages (Simple, Exponential, Weighted), Parabolic SAR, and the Moving Average Convergence Divergence (MACD).

Is RSI a leading or lagging indicator

The relative strength index (RSI) is a technical indicator that can act as both a leading and lagging indicator. In its absolute sense, it is a lagging indicator, because the price has to move first for the indicator to start moving in that direction. It basically moves with the price, with a slight delay.

What is the difference between lag and lead

Leads are the predicted measurement of how long it will take to do something while lags measure how far behind a task or project phase is after it has started. A lead can include many lags but lags do not account for leads.

What are lagging indicators of KPI

Lagging indicators in business are a kind of key performance indicator (KPI) which measure business performance after the fact, such as sales, customer satisfaction, or revenue churn. They can be difficult or impossible to influence directly.

What are 4 lagging economic indicators

Economic Lagging Indicators

Some general examples of lagging indicators include the unemployment rate, corporate profits, and labor cost per unit of output. Interest rates can also be good lagging indicators since rates change as a reaction to severe movements in the market.

Is GDP growth a lagging indicator

GDP: Gross Domestic Product (GDP) growth, used as a measure of economic health, is actually a lagging indicator of the economy, as the measure is always slightly behind the reality. While GDP growth provides valuable information about the economy, the measure doesn't point to the future but to the past.

Is RSI leading or lagging

Leading indicator: Relative Strength Index (RSI)

In its absolute sense, it is a lagging indicator, because the price has to move first for the indicator to start moving in that direction. It basically moves with the price, with a slight delay. That said, it can be a leading indicator.

Is MACD leading or lagging

MACD is a lagging indicator. After all, all the data used in MACD is based on the historical price action of the stock. Because it is based on historical data, it must necessarily lag the price. However, some traders use MACD histograms to predict when a change in trend will occur.

Is EMA leading or lagging

Exponential Moving Average (EMA): The EMA is a lagging indicator that is a resultant from the SMA calculation; the only difference being that the EMA favours more recent price movements.

What are leading and lagging indicators in project management

Lead indicators are after-the-event estimation fundamental to progress. It's an output measure that helps project managers record events and estimate results. Examples of lag indicators are counting the number of accidents on a worksite, employee turnover, or calculating how much sales you make in a month.

What is a leading indicator KPI

What are Leading Indicator KPIs Leading Indicators can help predict what will happen in the future. They let you know if you are on track to achieve the results you want. Leading Indicators are measurable, and you have the ability to influence or move them.

Is CPI a leading or lagging indicator

Consumer price index (CPI) is one of the most common lagging indicators and is typically used as the headline figure for inflation. It's calculated by taking the average weighted cost of a basket of goods and services, comparing the cost to previous months and years.

Why inflation is a lagging indicator

Is Inflation a Lagging Indicator Yes, inflation can be considered a lagging indicator. Inflation is defined as a period of rising prices, and when prices go up, people can't afford as much as they used to; therefore, inflation is also a period of declining purchasing power.

Is GDP lagging or leading

GDP: Gross Domestic Product (GDP) growth, used as a measure of economic health, is actually a lagging indicator of the economy, as the measure is always slightly behind the reality. While GDP growth provides valuable information about the economy, the measure doesn't point to the future but to the past.

Is EMA leading or lagging indicator

lagging indicator

Exponential Moving Average (EMA): The EMA is a lagging indicator that is a resultant from the SMA calculation; the only difference being that the EMA favours more recent price movements.

Is Bollinger Bands a leading indicator

The Bollinger band tool is a lagging indicator, as it is based on a 20-day simple moving average (SMA) and two outer lines.