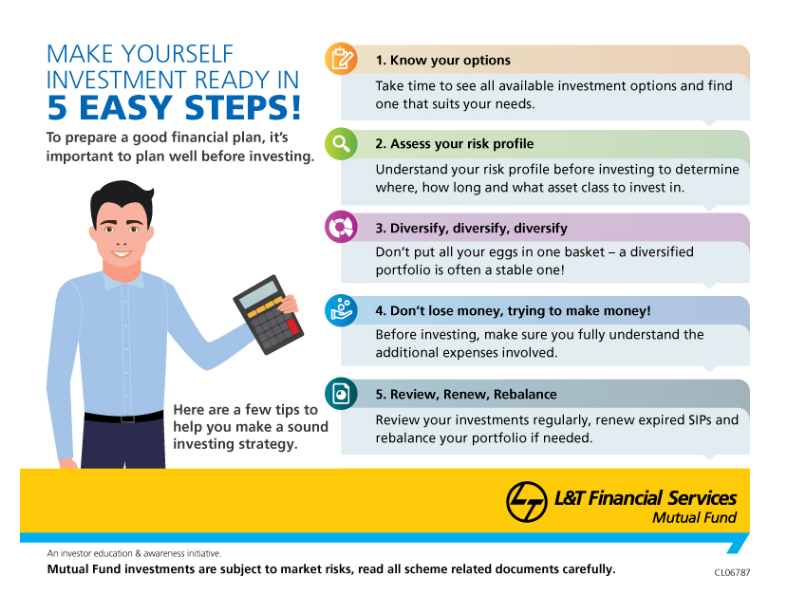

What are the 5 steps of investing

Step 1: Assess your risk tolerance. ConservativeStep 2: Diversify your investment. Balancing risk and return is the key to long-term investment.Step 3: Have a plan for asset allocation. Hit your investment targets with the right approach.Step 4: Assess investment performance.Step 5: Rebalance your investment portfolio.

What is the start step to start investing

Your investing journey starts with a plan and a time frame; when you know how long you're investing for and what you hope to gain, you can put the structure in place to achieve it. Next, learn about how the market works, figure out what investment strategy is best for you, and determine what kind of investor you are.

What is the process of investing

An Investment Process is a structured and systematic procedure used by investors to identify, evaluate, and manage an investment portfolio in order to achieve financial objectives. It aims to minimize the risk of investors and helps them to avoid emotional investment decisions.

What is principle 5 strategic investment

Principle 5: Strategic investment

It is the methods that the learner employs to internalize and to perform in the language that are important too. After all, successful mastery of L2 will be due to a learner's own personal investment of time, effort, and attention to L2.

What are the 8 simple steps to start investing

How To Begin Investing In 8 StepsLearn your investment options.Determine how much to invest.Start investing in a 401(k)Open an investment account.Choose your investment strategy.Start investing early.Work with a financial advisor.Build your investment portfolio.

What are the 4 stages of investment

The four phases of the investment cycle are:Plan Strategically. Assess, set and communicate sector priorities, and identify projects for implementation.Design Investment. Analyze context and alternatives and carry out detailed project design.Implement and Monitor.Evaluate and Capitalize.

What are the 10 principles of investing

Ten Principles to Investment SuccessInvest For Real Returns. The true objective for any long-term investor is maximum total real return after taxes.Keep An Open Mind.Never Follow The Crowd.Everything Changes.Avoid The Popular.Learn From Your Mistakes.Buy During Times Of Pessimism.Hunt For Value And Bargains.

What are the main principles of investing

Principles for investing successGoals. Create clear, appropriate investment goals. An appropriate investment goal should be measurable and attainable.Balance. Develop a suitable asset allocation using broadly diversified funds.Cost. Minimize cost.Discipline. Maintain perspective and long-term discipline.

What are the 4 rules of investing

Principles for investing successGoals. Create clear, appropriate investment goals. An appropriate investment goal should be measurable and attainable.Balance. Develop a suitable asset allocation using broadly diversified funds.Cost. Minimize cost.Discipline. Maintain perspective and long-term discipline.

What are the 7 levels of investors

The Seven Levels of Investors According to Robert KiyosakiLevel 0: Those with Nothing to Invest. These people have no money to invest.Level 1: Borrowers.Level 2: Savers.Level 3: “Smart” Investors.Level 3a: “I Can't Be Bothered” type.Level 3b: “Cynic” type.Level 3c: “Gamblers” type.Level 4: Long-term Investors.

What are the first 4 steps to financial success

Your 4-step guide to financial planningAssess your financial situation and typical expenses. An important first step is to take stock of your current financial situation.Set your financial goals.Create a plan that reflects the present and future.Fund your goals through saving and investing.

What are the three basic rules of investing

The 3 simple rules of investing that every investor, new or experienced, needs to knowRule #1: Don't lose money.Rule #2: Don't forget rule #1.Rule #3: Make money.

What is the rule of 7 in investing

At 10%, you could double your initial investment every seven years (72 divided by 10). In a less-risky investment such as bonds, which have averaged a return of about 5% to 6% over the same time period, you could expect to double your money in about 12 years (72 divided by 6).

What are the 3 keys to investing

Create a tailored investment plan. Invest at the right level of risk. Manage your plan.

What are the 7 steps of financial planning

7 Steps of Financial PlanningEstablish Goals. To begin, ask some questions about your future.Assess Risk.Analyze Cash Flow.Protect Your Assets.Evaluate Your Investment Strategy.Consider Estate Planning.Implement and Monitor Your Decisions.

What are the 8 steps of financial planning

8 steps to a flexible financial planStep 1: Set your goals.Step 2: Make a budget.Step 3: Build your emergency savings.Step 4: Protect your income.Step 5: Ditch the debt.Step 6: Save and plan for retirement.Step 7: Invest some of your savings.Step 8: Make your final plans.

What are the 6 rules of investing

The six golden rules of investingKeep some cash ready. Life's full of surprises.Start investing early. The earlier you invest, the more time your money has to grow into a nice sum.Focus on the long term.Don't put all your eggs in one basket.If in doubt, seek professional advice.Make the most of your tax-wrappers.

What is the 3 6 9 rule investing

Once you have this amount in your emergency savings account, you can focus on growing it to your personal savings target while also tackling other goals. Those general saving targets are often called the “3-6-9 rule”: savings of 3, 6, or 9 months of take-home pay.

What is rule 69 in investment

The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

What is the 4 rule investing

The 4% rule is easy to follow. In the first year of retirement, you can withdraw up to 4% of your portfolio's value. If you have $1 million saved for retirement, for example, you could spend $40,000 in the first year of retirement following the 4% rule.

What are the 4 C’s of investing

Trade-offs must be weighed and evaluated, and the costs of any investment must be contextualized. To help with this conversation, I like to frame fund expenses in terms of what I call the Four C's of Investment Costs: Capacity, Craftsmanship, Complexity, and Contribution.

What are the 6 steps of financial planning

Financial Planning Process1) Identify your Financial Situation.2) Determine Financial Goals.3) Identify Alternatives for Investment.4) Evaluate Alternatives.5) Put Together a Financial Plan and Implement.6) Review, Re-evaluate and Monitor The Plan.

What are the 7 components of a financial plan

A good financial plan contains seven key components:Budgeting and taxes.Managing liquidity, or ready access to cash.Financing large purchases.Managing your risk.Investing your money.Planning for retirement and the transfer of your wealth.Communication and record keeping.

What are the 4 golden rules of investing

They are: (1) Use specialist products; (2) Diversify manager research risk; (3) Diversify investment styles; and, (4) Rebalance to asset mix policy. All boringly straightforward and logical.

What is the 80 20 rule investing

Based on the application of famed economist Vilfredo Pareto's 80-20 rule, here are a few examples: 80% of your stock market portfolio's profits might come from 20% of your holdings. 80% of a company's revenues may derive from 20% of its clients. 20% of the world's population accounts for 80% of its wealth.