What are the 4 principles of IFRS

IFRS requires that financial statements be prepared using four basic principles: clarity, relevance, reliability, and comparability. The principle of clarity requires that financial statements be easy to read and easy to understand.

What is IFRS 4 explain

IFRS 4 is an International Financial Reporting Standard (IFRS) issued by the International Accounting Standards Board (IASB) providing guidance for the accounting of insurance contracts.

What are IFRS standards and principles

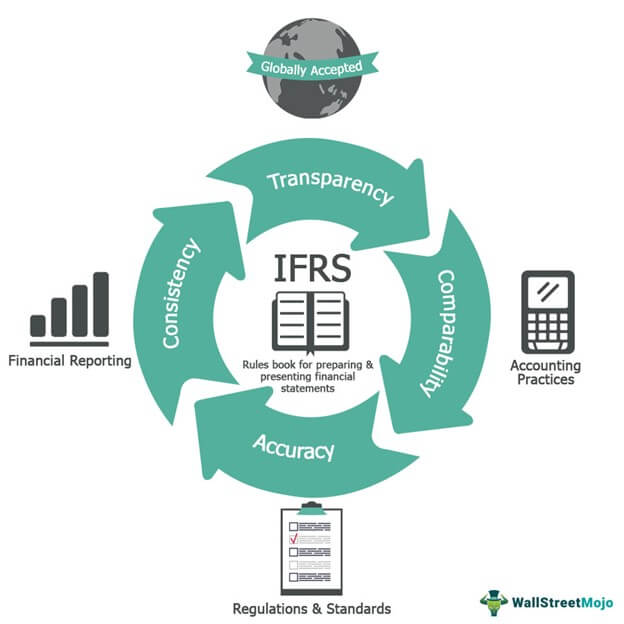

International Financial Reporting Standards (IFRS) are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and easily comparable around the world. The IFRS is issued by the International Accounting Standards Board (IASB).

What are IFRS principles and objectives

The objectives of the IFRS Foundation are: to develop, in the public interest, a single set of high quality, understandable, enforceable and globally accepted financial reporting standards based upon clearly articulated principles.

What are the 4 pillars of financial accounting

Everyone has four basic components in their financial structure: assets, debts, income, and expenses. Measuring and comparing these can help you determine the state of your finances and your current net worth. You can think of them as the vital signs of your financial circumstances.

What are the 5 elements of IFRS

This chapter describes the objective and scope of financial statements and provides a description of the reporting entity. This chapter defines the five elements of financial statements—an asset, a liability, equity, income and expenses.

What is the objective of IFRS 4

The IFRS 4 enables the insurer to change its accounting policies for insurance contracts only when its financial statements present data that is more relevant and no less reliable as well as no less relevant.

What are the 4 elements of an insurance contract

Lesson 2 Review. There are four necessary elements to comprise a legally binding contract: (1) Offer and acceptance, (2) consideration, (3) legal purpose, and (4) competent parties. The effective date of a policy is the date the insurer accepts an offer by the applicant "as written."

Is IFRS rules or principles based

The largest difference between the US GAAP (Generally Accepted Accounting Principles) and IFRS is that IFRS is principle-based while GAAP is rule-based. Rule-based frameworks are more rigid and allow less room for interpretation, while a principle-based framework allows for more flexibility.

What are the principles of IFRS 8

IFRS 8 objectives

This principle requires an entity to disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates.

Why is IFRS principles based

The largest difference between the US GAAP (Generally Accepted Accounting Principles) and IFRS is that IFRS is principle-based while GAAP is rule-based. Rule-based frameworks are more rigid and allow less room for interpretation, while a principle-based framework allows for more flexibility.

What are the core principles of IFRS 8

IFRS 8 requires an entity to disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates.

What are the 4 basic function of accounting

The primary functions of accounting are to track, report, execute, and predict financial transactions. The basic function of financial accounting is to also prepare financial statements that help company leaders and investors to make informed business decisions.

What are the 4 C’s of accounting

Note: The 4 C's is defined as Chart of Accounts, Calendar, Currency, and accounting Convention. If the ledger requires unique ledger processing options.

What are the 4 major elements of financial accounting

“Show me the money!”

They show you the money. They show you where a company's money came from, where it went, and where it is now. There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity.

What is IFRS 5 in accounting

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations outlines how to account for non-current assets held for sale (or for distribution to owners).

What are the principal objectives of IFRS 7

The objective of IFRS 7 is to provide disclosures in their financial statements that enables users to evaluate the significance of financial instruments for the entity's financial position and performance as well as the nature and extent of risks arising from financial instruments to which the entity is exposed during …

What are the 5 main elements of an insurance contract

These elements are a definable risk, a fortuitous event, an insurable interest, risk shifting, and risk distribution.

What are the principles of insurance contract

In the insurance world there are six basic principles that must be met, ie insurable interest, Utmost good faith, proximate cause, indemnity, subrogation and contribution. The right to insure arising out of a financial relationship, between the insured to the insured and legally recognized.

Is IFRS 17 principle-based

IFRS 17 provides principle-based requirements that aim to improve the comparability of the measurement and presentation of insurance contracts across entities reporting in jurisdictions applying International Financial Reporting Standards (IFRS).

What are the principle and rule-based concepts

In general terms, Principle-based approach means relying on high-level, broadly stated Principles rather than detailed, prescriptive rules. While the rule-based approach strictly requires people to follow descriptive processes, practices, the principle-based approach is more outcome-oriented.

What are the 5 basic accounting principles

What are the 5 basic principles of accountingRevenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle.Cost Principle.Matching Principle.Full Disclosure Principle.Objectivity Principle.

Is IFRS rules or principles-based

The largest difference between the US GAAP (Generally Accepted Accounting Principles) and IFRS is that IFRS is principle-based while GAAP is rule-based. Rule-based frameworks are more rigid and allow less room for interpretation, while a principle-based framework allows for more flexibility.

Is IFRS principle-based or rule-based

IFRS is a set of international accounting standards, which state how particular types of transactions and other events should be reported in financial statements. Some accountants consider methodology to be the primary difference between the two systems; GAAP is rules-based and IFRS is principles-based.

What is the core principle of IFRS 11

The core principle of IFRS 11 is that a party to a joint arrangement determines the type of joint arrangement in which it is involved by assessing its rights and obligations and accounts for those rights and obligations in accordance with that type of joint arrangement.