What is averaging in stock market

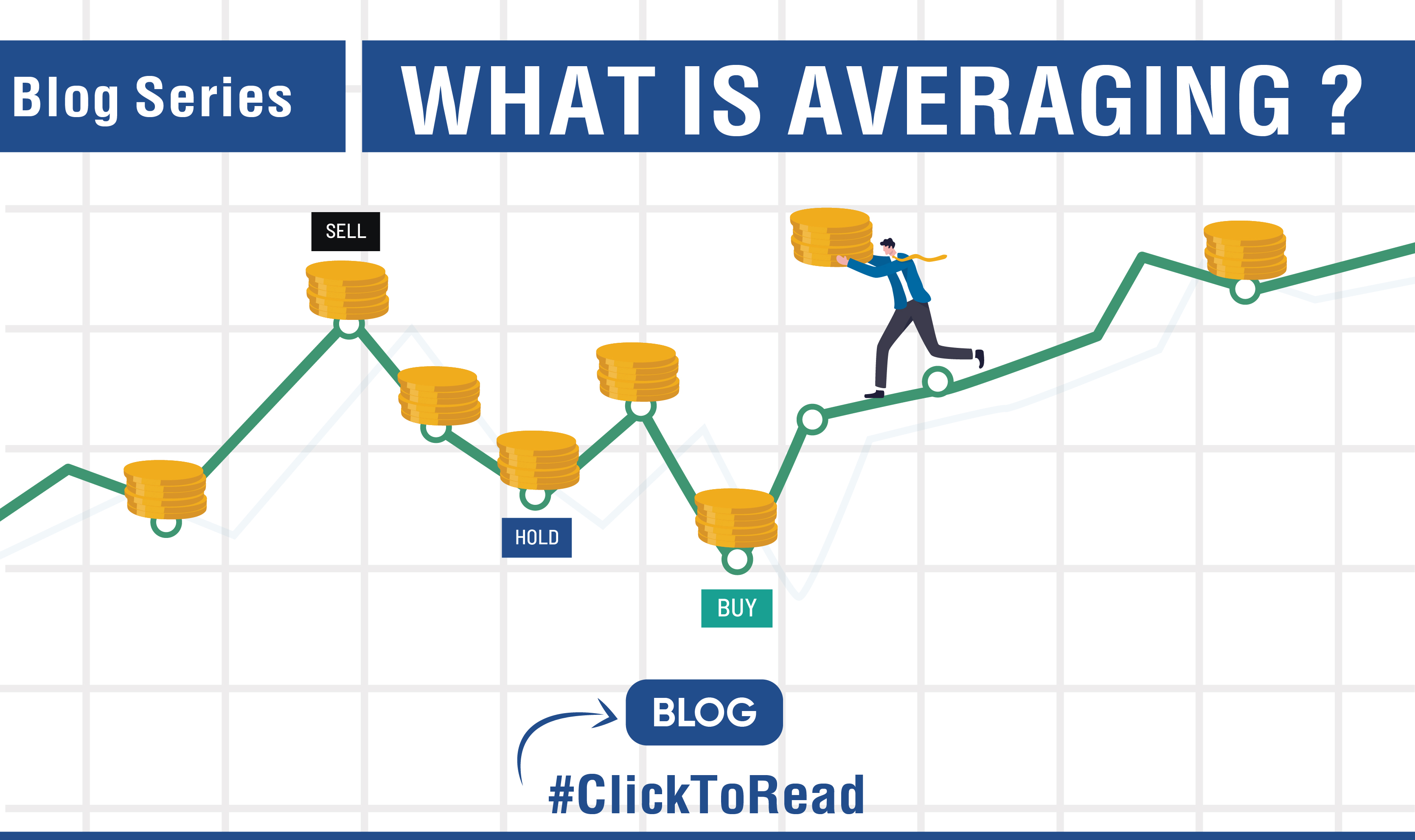

Averaging is the process of buying more stocks when the price of a stock falls further to bring down the overall cost of holdings by a particular investor.

Is averaging good or bad in stock market

Averaging down is only effective if the stock eventually rebounds because it has the effect of magnifying gains. However, if the stock continues to decline, losses are also magnified.

How does averaging work

Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of price. By using dollar-cost averaging, investors may lower their average cost per share and reduce the impact of volatility on the their portfolios.

Is averaging up good or bad

Average up refers to the process of buying additional shares of a stock one already owns, but at a higher price. Averaging up can be an attractive strategy to take advantage of momentum in a rising market or where an investor believes a stock's price will rise.

Is averaging a good strategy in trading

Is it better to average up or down in stocks It depends on your trading strategy and plan. Both averaging up and averaging down are used to scale into position, and scaling in is best suited for a long-term trading approach, even though short-term traders might attempt averaging up.

What is averaging strategy

Averaging, in the stock market, is a bundle of comprehensive trading strategies that involve the fundamental principle of reducing or increasing your share prices to overcome market volatility. There are multiple kinds of averaging strategies a trader can use in a variety of market settings.

Is 100% stocks a bad idea

In theory, young people investing for retirement should absolutely have 100% of their portfolio invested in equities. The biggest risk in the stock market is a crash which brings lower prices. Your best-case scenario as a young saver/investor is that you get to put more savings to work at lower prices.

What are the three techniques for averaging

Based on the physical concepts used to formulate multiphase transport phenomena, the averaging methods can be classified into three major groups: (1) Eulerian averaging, (2) Lagrangian averaging, and (3) molecular statistical averaging. The chapter reviews these averaging techniques.

Do you lose money averaging up

This increases the average price paid for a position, but if you are buying into an up-trend, it can amplify your returns. Like averaging down, an average-up strategy could result in larger losses if the stock falls sharply from a peak.

Do you lose money averaging down

There's no way to tell a set break-even point when you are averaging down. The strategy is only effective if the stock eventually rebounds, and the price goes back up. If it continues to fall, you'll lose money, and it's just a question of when you need to cut your losses.

What are the pros and cons of averaging down

Pros and Cons of Averaging Down

Buying more shares as the price drops reduces your average cost per share. If sentiment improves later and the share price goes up, you stand to earn more profits from your ownership of more shares. The main disadvantage of averaging down is increased risk.

Is it better to average down or sell and rebuy

To sum it up, the main advantage to averaging down is that you'll have a lower cost basis per share. In our example, if the stock rebounds to $40, you'll make money. But if you hadn't averaged down and had just held your original 100-share investment, a rebound to $40 would still leave you down $10 a share.

Why do we do averaging

Why should you calculate the average Calculating the average is a way to analyze a set of numbers and find a central value. For example, if you're teaching a class of students and you assign them a test, you can analyze the average grade on the test to find out how well the class did on the test, as a whole.

Is 35 stocks too many

Private investors with limited time may not want to have this many, but 25-35 stocks is a popular level for many successful investors (for example, Terry Smith) who run what are generally regarded as relatively high concentration portfolios.

Is 10% in one stock too much

Key Insights. Concentrated positions of company stock can carry more market risk than a diversified portfolio, coupled with career risk tied to the company. Holding more than 5% to 10% of your portfolio in company stock is a level of concentration that merits attention.

What are the 4 types of averages

Did you know that there are four different types of Average We consider there to be four types of average: mean, mode, median and range. Actually, range is a measure of spread or distribution but the others are our most common “measures of central tendency”.

What is the best method of average

mean

The most widely used method of calculating an average is the 'mean'. When the term 'average' is used in a mathematical sense, it usually refers to the mean, especially when no other information is given.

Is cost averaging effective

Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs.

What are the dangers of averaging down

The problem with averaging down is that the average investor has very little ability to distinguish between a temporary drop in price and a warning signal that prices are about to go much lower.

Is averaging down a good strategy

The equation explains that investors can break even or book profits more quickly by using an average down strategy than they would otherwise. Thus, when stock prices rise average down approach will earn large profits for the investor as the investor purchases additional shares at a lower price.

What are the disadvantages of averaging down

The main disadvantage of averaging down is increased risk. By averaging down, you're also increasing the size of your investment. So if the share price continues to fall, your losses will become greater than your original position.

What is the danger of averaging

Averages are inherently reductive and often misleading. Averages are dehumanizing; no meaningful problem was solved by looking at averages. Averages don't provide answers, only stereotypes. Sadly, averages are typically a little true – enough to keep this misnomer going.

What is the problem with averaging

It is statistical err to apply the average of a group of data points to a single point and assume it to be true. Even assuming data is normally distributed (a “bell curve”), the probability that any one data point will be the same as the average is 50% — the same as a random guess.

Is 100% stocks too risky

In any given decade, stocks can and do crash.

If you have no more than a decade to plan for, you certainly wouldn't invest 100% of your money in stocks. But when you're under 40, you have several decades before retirement. That's long enough to take advantage of the long-term trend in stocks.

What is the 80 rule in stocks

In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.