What is the 2% rule in trading

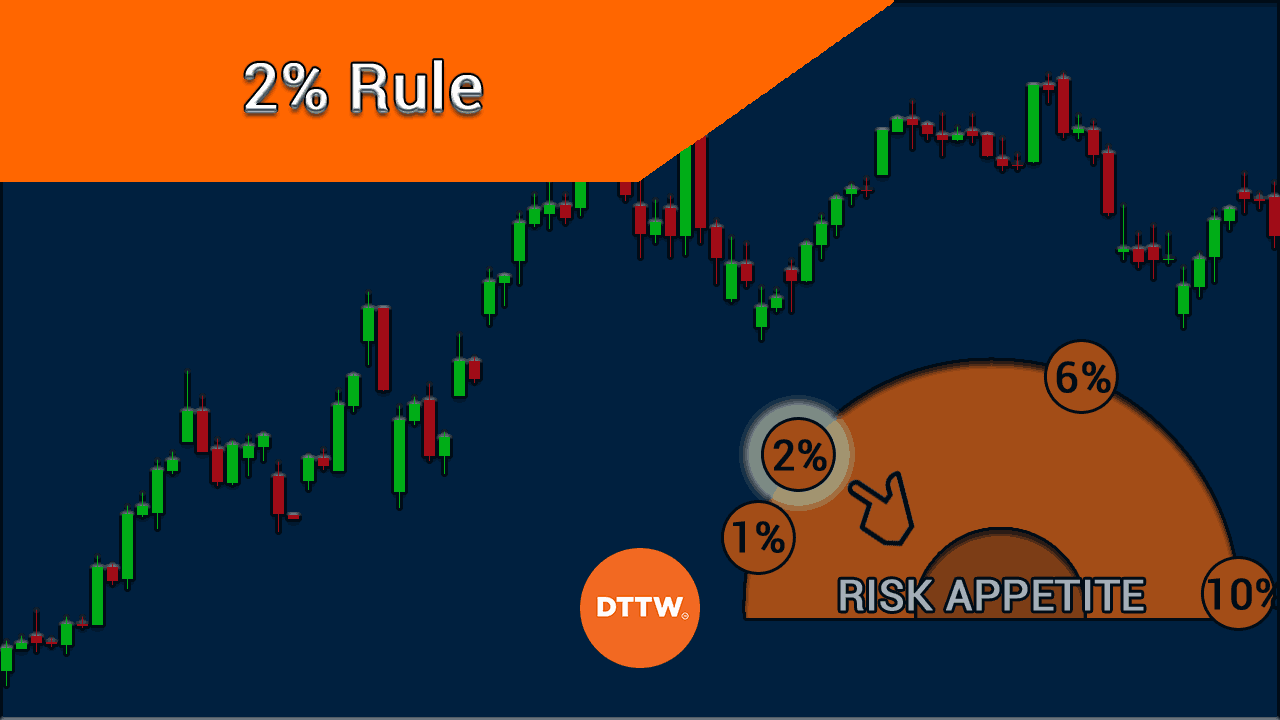

One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.

What is the 1 percent rule in risk management

A lot of day traders follow what's called the one-percent rule. Basically, this rule of thumb suggests that you should never put more than 1% of your capital or your trading account into a single trade. So if you have $10,000 in your trading account, your position in any given instrument shouldn't be more than $100.

What is the risk percentage for day trading

The 1% risk rule means not risking more than 1% of account capital on a single trade. It doesn't mean only putting 1% of your capital into a trade. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position.

Can you day trade with $100 dollars

Day trading can be stressful for inexperienced traders. This is why some people decide to try day trading with small amounts first. For example, trading with a bankroll of only $100 is possible but will require some extra amendments to manage risk and gain a healthy profit.

What is the 1% day trading rule

Ideal position size will vary by strategy and portfolio size, but a good rule of thumb is you shouldn't risk much more or less than 1% of your portfolio on each trade.

What is the 1% trade rule

This rule means that you must never risk more than 1% of your account value on a single trade. You can use all your capital or more (via MTF) on a trade but you must take steps to prevent losses of more than 1% in one trade.

What is the 2% risk rule

The 2% rule is an investing strategy where an investor risks no more than 2% of their available capital on any single trade. To implement the 2% rule, the investor first must calculate what 2% of their available trading capital is: this is referred to as the capital at risk (CaR).

Should I risk 1% or 2%

Traders with trading accounts of less than $100,000 commonly use the 1% rule. While 1% offers more safety, once you're consistently profitable, some traders use a 2% risk rule, risking 2% of their account value per trade. 6 A middle ground would be only risking 1.5%, or any other percentage below 2%.

Can I risk 3% per trade

You will need to have a proper money management system. It starts with identifying what level of risk % per trade will you risk. As a guide, a safe and good risk percentage will be from 1% – 3%. Anything higher than 3% will be relatively risky.

Is it possible to make 10 percent a day trading

The More Capital, the Harder It Is To Maintain High-Percentage Returns. Making 10% to 20% is quite possible with a decent win rate, a favorable reward-to-risk ratio, two to four (or more) trades each day, and risking 1% of account capital on each trade.

Is $500 enough to day trade

There you got, in case you were wondering if it's possible to day trade with $500. Yes, it's possible, but it has its own downsides. I advise you that before putting real money into the markets, you start trading with a paper account or you can choose some online casino usa.

Is it possible to make 1% per day trading

Making 1% a day in the markets, unfortunately, isn't a realistic goal. That's not too strange, considering that returns of that kind easily would add up to yearly returns of 1000% or more. A more realistic view of what a high performing trader might make per day on average, is somewhere around 0.15% a day.

Can I risk 5% per trade

A good rule of thumb is to risk between 1% and 5% of your account balance per trade. Even at 5%, this gives you a fighting chance if many consecutive losses take place and you've had a bad run in the markets.

What is 1% for day traders

Career day traders use a risk-management method called the "1% risk rule," or vary it slightly to fit their trading methods. Adherence to the rule keeps capital losses to a minimum when a trader has an off day or experiences harsh market conditions, while still allowing for great monthly returns or income.

What is 20% trading rule

Here are a few 80-20 rule examples: 80% of your portfolio's returns in the market may be traced to 20% of your investments. 80% of your portfolio's losses may be traced to 20% of your investments. 80% of your trading profits in the US market might be coming from 20% of positions (aka amount of assets owned).

What does 2 risk reward ratio mean

Since the trader stands to make double the amount that they have risked, they would be said to have a 1:2 risk/reward ratio on that particular trade. Derivatives contracts such as put contracts, which give their owners the right to sell the underlying asset at a specified price, can be used to similar effect.

What does 2% risk mean

What Is the 2% Rule The 2% rule is an investing strategy where an investor risks no more than 2% of their available capital on any single trade. To implement the 2% rule, the investor first must calculate what 2% of their available trading capital is: this is referred to as the capital at risk (CaR).

Is 1 to 2 risk-reward good

A good risk/reward ratio could be seen as greater than 1:3, where you would risk 1/4 of the overall potential profit. For trading to prove profitable in the long term, a trader should not typically risk their capital for a lower risk/reward ratio, as this will mean that half or more of their investment could be lost.

Is it 1% or 2% risk per trade

Risk per trade should always be a small percentage of your total capital. A good starting percentage could be 2% of your available trading capital. So, for example, if you have $5000 in your account, the maximum loss allowable should be no more than 2%. With these parameters, your maximum loss would be $100 per trade.

How do you calculate 2% risk per trade

How to Apply the 2 Percent RuleCalculate 2 percent of your trading capital: your Capital at Risk.Deduct brokerage on the buy and sell to arrive at your Maximum Permissible Risk.Calculate your Risk per Share:The Maximum Number of Shares is then calculated by dividing your Maximum Permissible Risk by the Risk per Share.

Can you make 1% a day trading

Making 1% a day in the markets, unfortunately, isn't a realistic goal. That's not too strange, considering that returns of that kind easily would add up to yearly returns of 1000% or more. A more realistic view of what a high performing trader might make per day on average, is somewhere around 0.15% a day.

Why do I need $25 000 to day trade

Why Do You Need $25,000 To Day Trade The stock market is a heavily regulated space, and this is understandable. It's a high-risk market where traders can watch as all their money burns down to the last dollar. One of the most common requirements for trading the stock market as a day trader is the $25,000 rule.

Can you make 1 percent a day trading

Making 1% a day in the markets, unfortunately, isn't a realistic goal. That's not too strange, considering that returns of that kind easily would add up to yearly returns of 1000% or more. A more realistic view of what a high performing trader might make per day on average, is somewhere around 0.15% a day.

What is the 1% trading strategy

The 1% method of trading is a very popular way to protect your investment against major losses. It is a method of trading where the trader never risks more than 1% of his investment capital. The main motive behind this rule is in terms of protection – you are not risking anything other than what is available.

Can a day trader make 1% per day

No, traders can not make a 1% a day trading return every single time because, in that hypothetical case, after 260 trading working days, the annual return would be around unrealistically 1230%.