What is the 3 day rule in day trading

The three-day rule in stocks mandates that buyers and sellers in stock transactions fully settle their business within three days of executing a trade. A buyer must send payment to the brokerage firm involved in a trade within three business days of making a purchase.

What is the 3 day rule after a stock drop

Benzinga recommends that when a stock drops by “high single digits or more in terms of percent change,” investors give themselves three days before buying that stock. "By waiting 3 days to buy into a position, you can grow your profits and lessen your losses," Benzinga writes.

Why does it take 3 days to settle a trade

Under the T+3 regulation, if you sold shares of stock Monday, the transaction would settle Thursday. The three-day settlement period made sense when cash, checks, and physical stock certificates still were exchanged through the U.S. postal system.

What is the rule of 3 5 and 7 in trading

The strategy is very simple: count how many days, hours, or bars a run-up or a sell-off has transpired. Then on the third, fifth, or seventh bar, look for a bounce in the opposite direction. Too easy

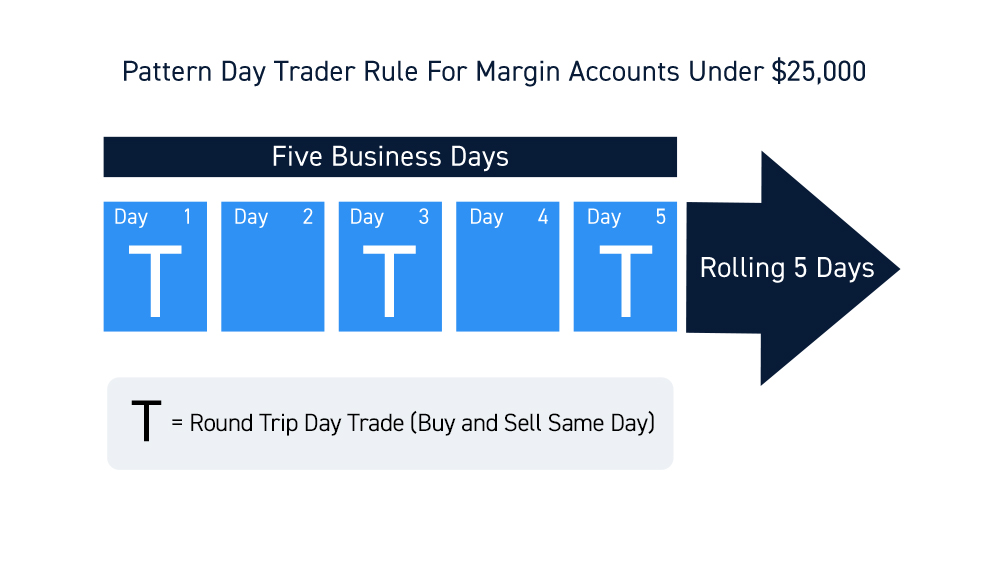

What happens if I do more than 3 day trades

If you execute four or more round trips within five business days, you will be flagged as a pattern day trader. Here's where you might be dinged: If you're flagged as a pattern day trader and you have less than $25,000 in your account, you could be restricted from opening new positions.

Can I do more than 3 day trades

You're generally limited to no more than three day trades in a five-trading-day period, unless you have at least $25,000 of equity in your account at the end of the previous day.

Do I have to wait 2 days to sell a stock

For most stocks, the standard period to receive the proceeds of a stock sale is two days. This is known as the T+2 settlement period.

How soon can I sell a stock after buying it

How soon can I sell a stock after buying There is no time limit on selling a stock after buying, you can sell straight away. But remember, it is conditional on another investor being willing to buy those shares from you.

What is 123 rule in trading

123 pattern is a common pattern that usually appears at the beginning of many price reversals. Sometimes, it might give a signal about trend continuation as well. To get higher quality signals it is better to use the 123 pattern in a tandem with an oscillator (for example RSI).

What is 20% trading rule

Here are a few 80-20 rule examples: 80% of your portfolio's returns in the market may be traced to 20% of your investments. 80% of your portfolio's losses may be traced to 20% of your investments. 80% of your trading profits in the US market might be coming from 20% of positions (aka amount of assets owned).

Can I day trade 3 times a day

You could inform your broker (saying “yes, I'm a day trader”) or day trade more than three times in five days and get flagged as a pattern day trader. This allows you to day trade as long as you hold a minimum account value of $25,000—just keep your balance above that minimum at all times.

What happens if I trade more than 3 times in a week

If you make four or more day trades over the course of any five business days, and those trades account for more than 6% of your account activity over the period, your margin account will be flagged as a pattern day trader account.

How many times can I trade per day

As a retail investor, you can't buy and sell the same stock more than four times within a five-business-day period. Anyone who exceeds this violates the pattern day trader rule, which is reserved for individuals who are classified by their brokers are day traders and can be restricted from conducting any trades.

Can I buy and sell the same stock 3 times a day

As a retail investor, you can't buy and sell the same stock more than four times within a five-business-day period. Anyone who exceeds this violates the pattern day trader rule, which is reserved for individuals who are classified by their brokers are day traders and can be restricted from conducting any trades.

How soon after I buy a stock can I sell it

How soon can I sell a stock after buying There is no time limit on selling a stock after buying, you can sell straight away. But remember, it is conditional on another investor being willing to buy those shares from you.

Can I sell stock 2 days after buying

Most stock trades settle two business days after the order executes. (Traders call this T+2, or the trade date plus two business days). An investor can trade on margin, but they'll pay interest on those borrowed funds during the settlement period.

What is the 80 20 rule in trading

Based on the application of famed economist Vilfredo Pareto's 80-20 rule, here are a few examples: 80% of your stock market portfolio's profits might come from 20% of your holdings. 80% of a company's revenues may derive from 20% of its clients. 20% of the world's population accounts for 80% of its wealth.

What is the 80% rule in trading

–If the market opens up inside of value and then trades out of value, the rule applies the same way. If the market can trade back inside value for two consecutive 30 minute periods, then it has an 80% chance of rotating to the other side of value.

Why 90% of traders lose money

Most new traders lose because they can't control the actions their emotions cause them to make. Another common mistake that traders make is a lack of risk management. Trading involves risk, and it's essential to have a plan in place for how you will manage that risk.

What happens if you exceed 3 day trades

If you execute four or more round trips within five business days, you will be flagged as a pattern day trader. Here's where you might be dinged: If you're flagged as a pattern day trader and you have less than $25,000 in your account, you could be restricted from opening new positions. So, what now

What happens if you trade more than 3 times

If you make four or more day trades over the course of any five business days, and those trades account for more than 6% of your account activity over the period, your margin account will be flagged as a pattern day trader account. (Note that you can day trade in a cash account.)

Can I make more than 3 day trades

A day trade is when you purchase or short a security and then sell or cover the same security in the same day. Essentially, if you have a $5,000 account, you can only make three-day trades in any rolling five-day period. Once your account value is above $25,000, the restriction no longer applies to you.

Can I buy a stock and then sell it the same day

You can buy and sell a stock on the same day, which is known as day trading, but there are certain restrictions which you need to be aware of.

What is the 50 50 rule in trading

As per this formula, investors should invest 50 per cent of their money in the equity market and 50 per cent in the debt market, and balance it from time to time. For example, if an investor wants to pumps in Rs 1,000 in total in the stock market, then he or she should invest Rs 500 in Debt and Rs 500 in equity.

What is the 40 60 rule in trading

In its simplest form, the 60/40 rule means having 60% of your portfolio invested in potentially higher risk, historically higher return, assets such as stocks and the other 40% invested in lower risk, but also traditionally lower return, assets such government bonds.