What is the maximum amount I can transfer online per day

2) Own account fund transfer — No limit (up to the available balance in debit account). 3) IMPS to registered beneficiary – up to Rs 5 Lakh per day/per transaction. 4) NEFT to registered beneficiary per day – up to Rs. 10 lakh./per transaction – up to Rs 5 lakh.

How much money can you transfer at once

There isn't a law that limits the amount of money you can send or receive. However, financial institutions and money transfer providers often have daily transaction limits. This depends entirely on the establishment. Some might have a $3,000 limit per day, while others might have none at all.

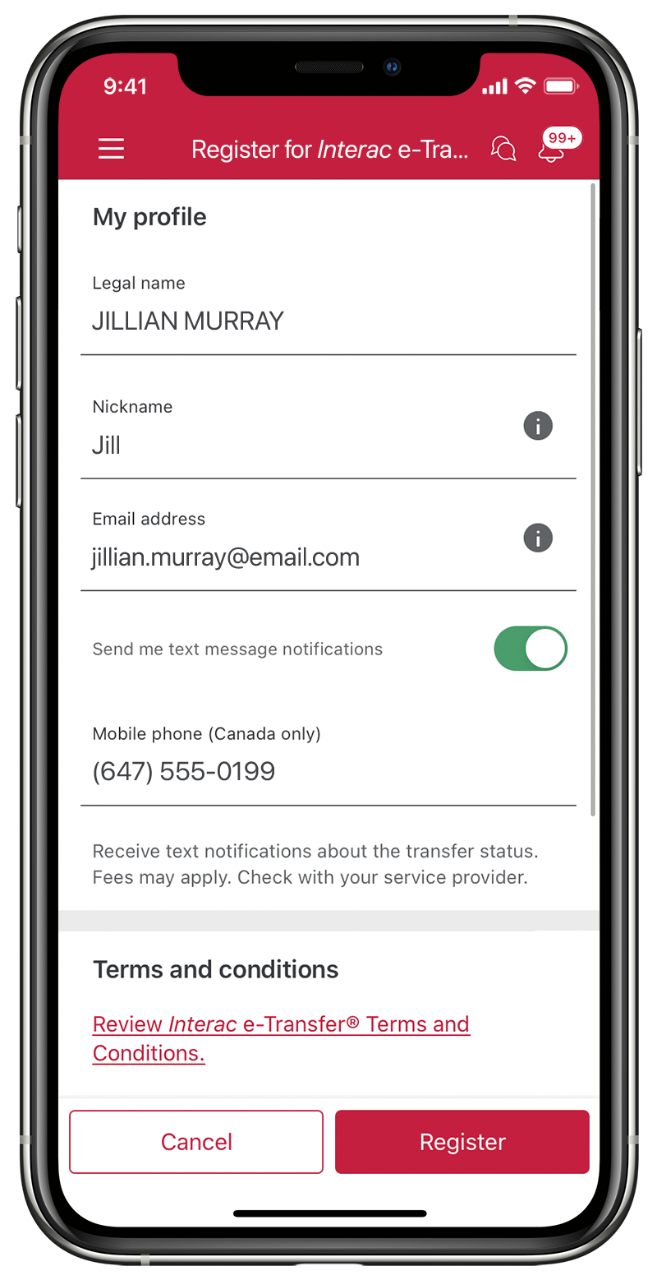

What is the transfer limit for Scotiabank

a $25,000

Yes, there is a $25,000 limit per Interac e-Transfer sent. However, there are no limits for accepting (receiving) an Interac e-Transfer. Was this information helpful

Is there a limit on electronic transfers

Is there a wire transfer limit Wire transfers are regulated under the Electronic Fund Transfer Act (EFTA), which does not put a limit on the amount of money a person can transfer. However, financial institutions often impose daily transaction limits on deposits and withdrawals from accounts.

How can I transfer large amounts online

RTGS works out as the best payment method if you need to transfer an amount equal to or more than Rs. 2 lakh in real time. RTGS does not follow any specific processing method unlike NEFT; hence, the funds are settled in real-time, without any delay.

How can I transfer large amounts of money internationally

Both Western Union and PayPal are popular choices for sending large sums of money overseas.

Are there limits on international wire transfers

First of all, there is no legal limit to the amount of money you can send to another country. However, in compliance with the FATCA, you have to report your account to the Financial Crimes Enforcement Network, especially if the transaction exceeds $10,000. In this case, you may also need to file Form 8938 with the IRS.

What is the e transfer limit in Canada

Per transfer limit: $3,000. Daily limit: $3,000. Weekly limit: $10,000. Monthly limit: $20,000.

How do I increase my e transfer limit

Increasing e-transfer limits

You can increase your TD Interac e-Transfer limit by increasing the daily debit limit in your TD Bank account. ² This feature is available on the TD Bank app or via the TD EasyWeb online banking platform.

What happens when you transfer over $10000

Financial institutions must file a Currency Transaction Report for any transaction over $10,000, and failure to comply with these requirements can result in significant penalties. By understanding the law and taking steps to ensure compliance, you can avoid penalties and ensure the integrity of the financial system.

How do I transfer 100k to another bank

Steps for Transferring Money Between BanksLog into your bank's website or connect via the bank's app.Click on the transfer feature and choose transfer to another bank.Enter the routing and account numbers for the account at the other bank.Make the transfer.

What happens if you transfer more than $10 000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

How much is a large e transfer

Personal Accounts: Up to $100: $0.50 per transfer. Over $100: $1.00 per transfer.

How much money can you transfer to someone overseas

There is no limit to the amount of money that you can travel with, receive and send overseas. You also don't need to declare money that you transfer overseas or receive from overseas through a bank or a remittance service provider (money transfer business).

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

Can I transfer $100000 from one bank to another

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

How do I transfer a large sum of money

Wire Transfers

You can send large sums of money from one bank account to another with a wire transfer. These types of transfers are initiated through a bank officer at the delivering bank who fills out the necessary forms. Wire transfers, for the most part, must be done in person.

How can I send large amounts of money internationally

Both Western Union and PayPal are popular choices for sending large sums of money overseas.

Can I transfer $50000 from one bank to another

If you're sending a large amount of money, you may want to use a wire transfer at your bank. You'll need the recipient's account and routing numbers. You and the recipient will likely incur fees. Wire transfers take place in less than 24 hours but do not occur on weekends or on bank holidays.

How can I send large amounts of money

Here are a few of the most common:Automated clearing house (ACH)Bank-to-bank.Money transfer.Cash-to-cash.Prepaid debit cards.Foreign currency check.International money transfer service.

Is it OK to transfer large amounts of money

Use a wire transfer

It's a good way to send money quickly and securely, especially large amounts of money or overseas transfers. It's safe for the sender as long as you know the recipient. And it's safe for the recipient because the funds are guaranteed (unlike a personal check, which can bounce).

How can I send large sums of money internationally

Both Western Union and PayPal are popular choices for sending large sums of money overseas. However, they can be expensive compared to other service providers.

Is there a limit on international money transfers

First of all, there is no legal limit to the amount of money you can send to another country. However, in compliance with the FATCA, you have to report your account to the Financial Crimes Enforcement Network, especially if the transaction exceeds $10,000. In this case, you may also need to file Form 8938 with the IRS.

How can I transfer large amounts internationally

How to transfer large sums of money internationally. To transfer a large sum of money internationally, you'll need to find a currency broker or bank that can handle this request for you. Your two main options are: Using a high street bank which can facilitate large transfers between two bank accounts.

How much international transfer is allowed

If you want to make a transaction, you must follow the rules established by the Reserve Bank of India: According to RBI regulations, remittances of up to USD 25,000 (INR 20,42,200) are allowed per calendar year.