What is the formula for time value method

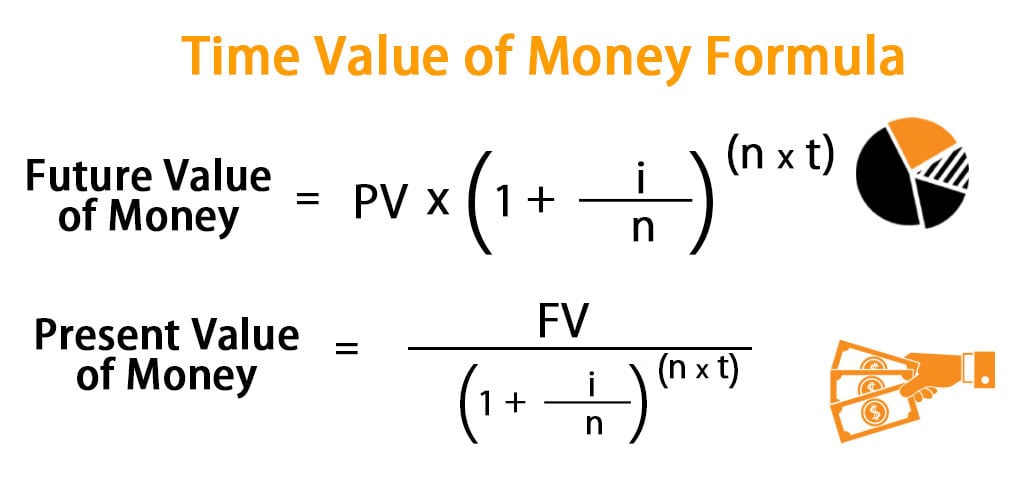

You can use the following formula to calculate the time value of money: FV = PV x [1 + (i / n)] (n x t).

What is the formula for calculating money

For each bill and coin value, multiply the number you have by the face value. For example, if you have 4 of $10 note multiply 4 × 10 to get $40. If you have 3 of the $5 note multiply 3 × 5 to get $15. Add all of the totals together to calculate the total sum of money.

What is the time value of money theory

The time value of money is the concept that money is worth more in the present than in the future due to its potential earning capacity, or alternatively, to inflation. If you invest $100 today, that money can start earning interest or dividends.

What is an example of time value money

An example of using TVM

This means the $15,000 you get for the car today will be worth $15,612 in two years. If you wait until two years from now to receive the $15,500 payment, you will lose out on $112 in interest you could have earned in that time.

What is the formula for present value and future value

The present value formula is PV = FV/(1 + i) n where PV = present value, FV = future value, i = decimalized interest rate, and n = number of periods. It answers questions like, How much would you pay today for $X at time y in the future, given an interest rate and a compounding period

What is the factor for time value of money

The exact time value of money is determined by two factors: Opportunity Cost, and Interest Rates.

What is the formula for calculating the present value of a single sum

Present value = Factor x Accumulated amount

For example, if we want to use the table to determine the present value of $15,000 to be received at the end of 5 years (compounded annually at 12%), we simply look down the 12% column and multiply that factor by $15,000.

What is the future value of $1000 after 5 years at 8% per year

$1,489.85

What is the future value of $1,000 after five years at 8% per year If compounding monthly, $1,489.85 is the total compound interest value after five years.

What is future value formula examples

Formula and Calculation of Future Value

For example, assume a $1,000 investment is held for five years in a savings account with 10% simple interest paid annually. In this case, the FV of the $1,000 initial investment is $1,000 × [1 + (0.10 x 5)], or $1,500.

How do you calculate future value

The future value formulafuture value = present value x (1+ interest rate)n Condensed into math lingo, the formula looks like this:FV=PV(1+i)n In this formula, the superscript n refers to the number of interest-compounding periods that will occur during the time period you're calculating for.FV = $1,000 x (1 + 0.1)5

What is the present value formula used for

The present value (PV) calculates how much a future cash flow is worth today, whereas the future value is how much a current cash flow will be worth on a future date based on a growth rate assumption.

What is a single amount in time value of money

What does it mean to say that money has “time value” Essentially it means that $1 (or €1 or ¥1 or £1) promised for some future date has a different value (usually lower) than the same amount today. For example, $100 promised two years from now might be worth $90 today.

What is the future value of $5500 in 17 years at an APR of 8.4 percent compounded semiannually

Hence, the FV is 22,277.43239.

What is the future value of $1580 in 15 years assuming an interest rate of 9.5 percent compounded semiannually

The future sum of money is $ 6,357.38

Substituting the values we have: r (rate) = 9.50% / 2 = 0.0475.

What is the formula for FV and PV

Future Value (FV) = PV × (1 + r) ^ n

Where: PV = Present Value. r = Interest Rate (%) n = Number of Compounding Periods.

What is the formula for PV and FV

In its most basic form, the formula for future value (FV) is FV= PV*(1+i)^n, where “PV” equals the present value, “i” represents the interest rate and “n” represents the number of time periods.

What is the formula for present value and example

PV = FV / (1 + r / n)nt

PV = Present value. FV = Future value. r = Rate of interest (percentage ÷ 100) n = Number of times the amount is compounding.

What is time value of money in Excel

Excel's FV function can be used to determine the future payment for a loan based on the periodic constant payment and a constant interest rate. The syntax of the FV Function is. =FV(rate, nper, pmt, [pv],[type])

What is the formula for FV factor

The FV Factor is equal to (1 +i)^n where i is the rate (e.g. interest rate or discount rate) and n is the number of periods. So for example at a 12% interest rate, $1 USD invested today would be worth (1 + 12%)^5 or $1.7623 USD five years from now.

How do you do FV and PV on a calculator

Problem. Once you are done with entering all the values except pv press cpt and then press pv. So you get pv equals 533.998 or 534.

Why do we calculate present value

Present value (PV) is a way of representing the current value of future cash flows, based on the principle that money in the present is worth more than money in the future. Present value is used to value the income from loans, mortgages, and other assets that may take many years to realize their full value.

What type of formula is present value

Present value (PV) is the current value of a stream of cash flows. PV analysis is used to value a range of assets from stocks and bonds to real estate and annuities. PV can be calculated in Excel with the formula =PV(rate, nper, pmt, [fv], [type]).

What is the formula of PV and FV

Key Takeaways

The present value formula is PV = FV/(1 + i) n where PV = present value, FV = future value, i = decimalized interest rate, and n = number of periods.

How do you calculate PV and FV

Which is 20 years. So it's going to be 10 000. Times 1.06 raised to the 20th. Power. Now let me go ahead and plug this.

What is PV vs FV formula in Excel

The formula for present value is: PV= FV / (1+r)^n, where PV=Present Value, FV=Future Value, r=interest rate per period in decimal form, n=number of periods/years you plan to hold onto your investment.