What is the timeframe H4 strategy

Now, probably most of you already know that in the forex trading and technical analysis realm, H4 is simply an abbreviation for the 4-hour daily time frame. The 4-hour time frame is an intraday TF where each corresponding candle encompasses exactly 4 hours of trading activity from open to close.

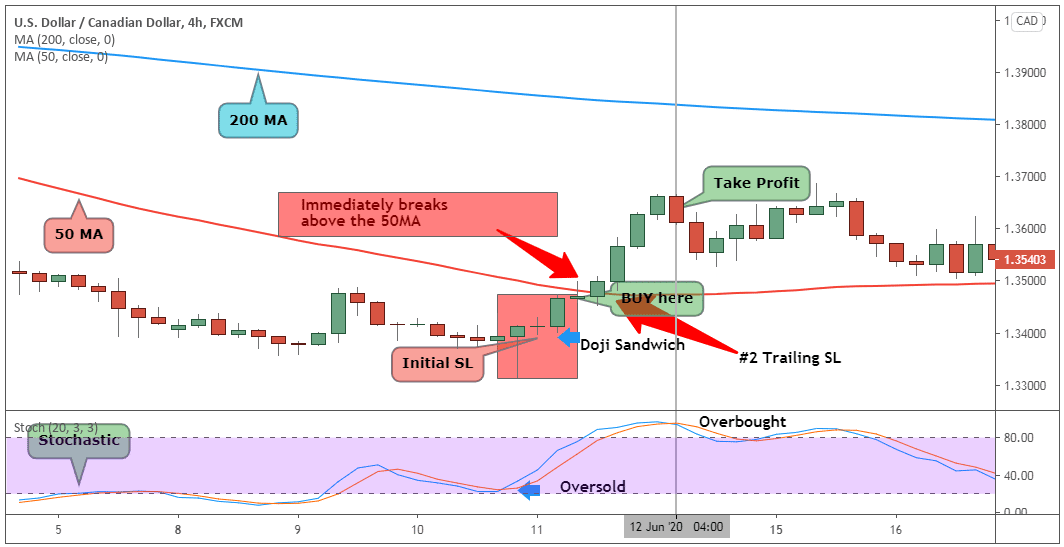

What is the H4 forex strategy

The H4 (4-hour) Forex trading strategy makes use of a fine combination of technical indicators that are applied to the 4-hour charts. This strategy offers a profitable way for traders to trade on the longer-term timeframes.

What time frame is best for trading

As a general rule, traders use a ratio of 1:4 or 1:6 when performing multiple timeframe analysis, where a four- or six-hour chart is used as the longer timeframe, and a one-hour chart is used as the lower timeframe.

What time is the 4-hour chart

Watch for the close of each 4-hour candle that you can. Using the New York close to define 'financial time' means that we're seeing candles close at 5, 9, and 1 AM and PM (based on ET). If you're using Central Time, that's 4, 8, and 12 AM/PM while Pacific Time is 2, 6, and 10 AM/PM.

What time do 4 hour candles close

Watch for the close of each four-hour candle that you can. Using the New York close to define 'financial time' means that we're seeing candles close at 5, 9, and 1 AM and PM (based on ET). If you're using Central Time, that's 4, 8, and 12 AM/PM while Pacific Time is 2, 6, and 10 AM/PM.

What time does the 4 hour candle start

For example, if a trader is using a broker based in the United States, the start time of a 4-hour candle will be based on the New York time zone. In this case, the first 4-hour candle of the trading week will start at 5 pm EST on Sunday and end at 9 pm EST.

What time does the 4 hour candle open

Each 4 hour candle on a chart represents a specific time frame, such as 4:00 AM to 8:00 AM, 8:00 AM to 12:00 PM, 12:00 PM to 4:00 PM, and so on. Each 4 hour candle displays the open, close, high, and low prices of a currency pair during that time frame.

What is the best moving average for H4

The best-moving average for 4 Hour chart is SMA76 because it provides the best Profit Factor of 1.17 in the testing case study. However, the best result in the moving average cross-over strategy showed EMA20 cross with EMA 50 of 1.21 Profit Factor.

Why trade higher time frames

The main advantage of trading on higher timeframes is that they provide a broader perspective of the market. This makes it easier to identify long-term trends and potential support and resistance levels. Higher timeframes can also help traders filter out noise and avoid false signals that may occur on lower timeframes.

What is the best EMA for a 5 min chart

Therefore, the exponential moving average may be considered the best moving average for a 5 min chart. A 20-period moving average will suit best. The MACD indicator is based on the exponential moving averages. Usually, it consists of two lines and a histogram.

Why is the 4 hour chart important

The 4-hour chart provides a more accurate picture of the market, which makes technical analysis more effective. It allows traders to identify key levels of support and resistance, trendlines, and chart patterns, which can be used to make trading decisions.

What is a time based chart

A time-based chart displays a bar every time the specified time interval ends. You can have a 20-second chart, 5-minute chart, 30-minute chart, daily chart, weekly chart, etc. In each case, the open, high, low, and closing prices for that time period are recorded in each bar.

What is the best 4 hour trading strategy

The best four-hour forex strategy is the breakout system when the RSI trendline is broken, and increased volume and economic news follow the current breakout. Usually, 4h time frame strategy is perfect for swing traders where the average trade duration is from several hours to a few days.

Which candle timing is best

The best time frame for candlesticks is daily bars and relatively short holding periods from 1 to ten days. Thus, candlesticks are most useful for short-term trading. We backtested different time frames from 15-minute bars to monthly bars.

What is the best EMA for 4 hour time frame

What is the Best Moving Average for 4 Hour Chart The best-moving average for 4 Hour chart is SMA76 because it provides the best Profit Factor of 1.17 in the testing case study. However, the best result in the moving average cross-over strategy showed EMA20 cross with EMA 50 of 1.21 Profit Factor.

What is the best time frame for 50 EMA

What Timeframe to Use for the 50 EMA Strategy. The 50 EMA strategy is typically used on medium-term timeframes, such as the 4-hour or daily charts. Using a longer timeframe can help to filter out noise and provide a clearer picture of the trend.

Are higher time frames better

The main advantage of trading on higher timeframes is that they provide a broader perspective of the market. This makes it easier to identify long-term trends and potential support and resistance levels. Higher timeframes can also help traders filter out noise and avoid false signals that may occur on lower timeframes.

Are higher timeframes better

Higher Time Frames ensure that one can easily analyze price action at a longer period and take better trading decisions, but it also requires the Virtue of Patience.

How to use 5 8 13 ema

Price the exact opposite crossover occurs between the ema signal lines when the price movement shifts to a bearish trend parabolic sar indicates the trends by signal dots those dots change states.

How do you trade a 5 minute timeframe

For an aggressive trade, place a stop at the swing low on the five-minute chart. For a conservative trade, place a stop 20 pips below the 20-period EMA. Sell half of the position at entry plus the amount risked; move the stop on the second half to breakeven.

How do you trade on a 4 hour chart

Here are a few additional tips you can use when swing trading the 4hr charts:Have the daily chart as your 'higher' time frame context. When in doubt, try to trade with this the most.Don't expect the market to go straight to your target.Mark your support and resistance levels on the daily & 4hr charts.

What graph is best for time based data

A line graph is the simplest way to represent time series data. It helps the viewer get a quick sense of how something has changed over time.

What are the three types of time graphs

Displacement-time graph, velocity-time graph, and acceleration-time graph are three common types of graphs in classical mechanics.

Why trade the 4 hour timeframe

Trading the 4-hour chart allows traders to better manage their risk. Since the signals on the 4-hour chart are more reliable, traders can use tighter stop-losses, which reduces their risk. Tighter stop-losses also allow traders to enter positions with larger positions sizes, which can increase their profits.

Is 4 hour time frame good for swing trading

Is the 4-hour chart good for swing trading The 4-hour chart is a good alternative to the daily swing trading timeframe. While price action is slightly more random than the daily timeframe, this chart gives you more opportunities to trade which can increase profitability.