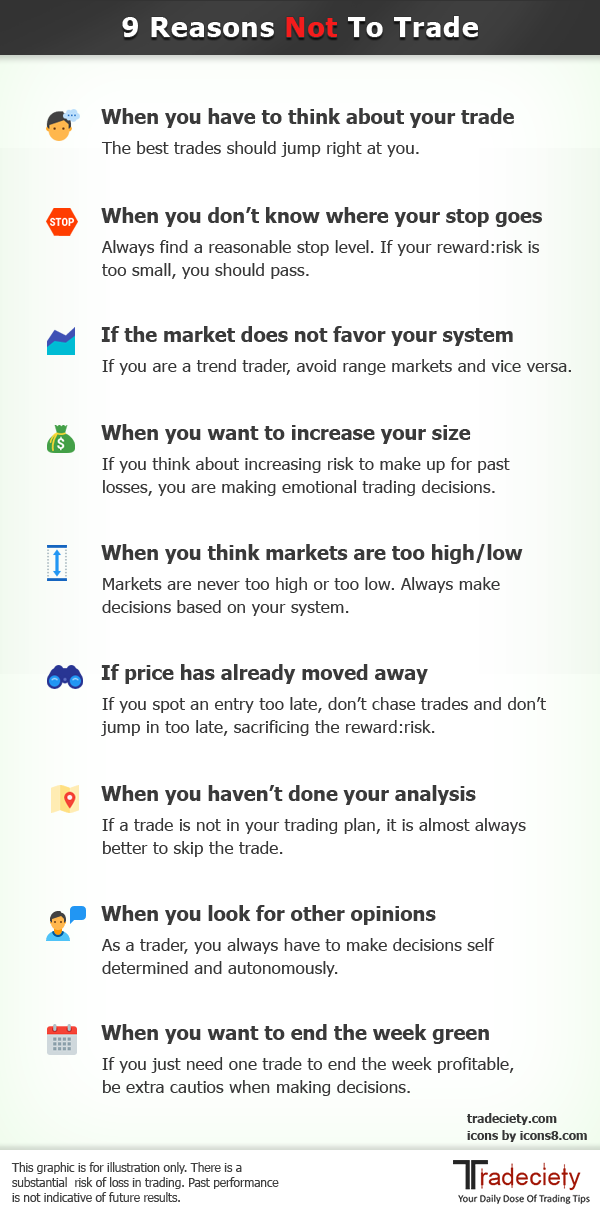

When should I not trade

If you can't find a reasonable price level for your stop loss, or you have to set your stop too far away and, therefore, have a reward:risk ratio that is too small, don't take that trade. Most amateurs fiddle with their stop until they think that the potential profit is large enough.

Why not to be a trader

Well, you start taking a larger risk because you want to make money fast. You're unwilling to cut your losses because you don't want to lose. You have such immense pressure on yourself and things eventually spiral out of control. Eventually, you blew up your trading account and you're still in debt.

What days should you not trade forex

Since there isn't much economic activity on weekends, it's also unlikely that the market will adjust to new conditions. Sunday night is the only time of the trading week, when gaps occur regularly for currency pairs. Therefore, Sunday is not the best day to trade the Forex market.

What are the hardest months to trade

Unless you're a short-term trader, the worst months to buy stocks are usually November, December, and April. Why Because during these months, there's a high probability stocks are at their peak valuations, so there aren't as many bargains in the market.

What is the 3 5 7 rule in trading

The strategy is very simple: count how many days, hours, or bars a run-up or a sell-off has transpired. Then on the third, fifth, or seventh bar, look for a bounce in the opposite direction. Too easy

How often do traders lose

Our research suggests that about 70 to 90% of traders lose money. It is, of course, impossible to get an exact number, but as a rule of thumb, we believe 70-90% is close to the “correct” ballpark figure.

Why 90% of traders fail

Most new traders lose because they can't control the actions their emotions cause them to make. Another common mistake that traders make is a lack of risk management. Trading involves risk, and it's essential to have a plan in place for how you will manage that risk.

Why do most traders quit

Lack of knowledge

This single biggest reason why most traders fail to make money when trading the stock market is due to a lack of knowledge. We can also put poor education into this arena because while many seek to educate themselves, they look in all the wrong places and, therefore, end up gaining a poor education.

Why is it bad to trade on Monday

It's called the Monday effect or the weekend effect. Anecdotally, traders say the stock market has had a tendency to drop on Mondays. Some people think this is because a significant amount of bad news is often released over the weekend.

What are bad months to trade forex

In June, July and August, volatility slows down due to the summer season, making it the worst time to trade forex. The reduced trading activity during summer results from the changing habits of large market movers.

What are the worst days to trade stocks

Thursdays and Fridays are the worst days to trade stocks during the week! Albeit the worst, both are still profitable because they benefit from the tailwind of the overnight edge: Night Strategies Trading (Overnight Trading Strategies)

What is the 80 20 rule in trading

Based on the application of famed economist Vilfredo Pareto's 80-20 rule, here are a few examples: 80% of your stock market portfolio's profits might come from 20% of your holdings. 80% of a company's revenues may derive from 20% of its clients. 20% of the world's population accounts for 80% of its wealth.

What is 80% trading rule

The 80/20 Rule – Coincidental Yet Consistent

If you're not already familiar with this notion, it's called the 80/20 Rule, or the Pareto Principle. To recap, it says that 80% of the effects (in our case, one's trading success rate) come from 20% of the causes.

Why do 90% of day traders fail

Lack of Risk Management

This can include setting stop-loss orders to limit losses, diversifying your positions to spread risk, and avoiding risky trades beyond your position sizing limits. Unfortunately, many traders fail to implement a solid risk management plan and take on more risk than they can handle.

Why 99% of traders lose money

Over trading is a scenario where one tries to take too many trades in a single day. Traders want to take advantage of every dip and fall. This is a psychological trait that people don't want to lose. And in order to recover those previous losses, young traders take another shot to break even.

Do 97% of traders lose money

On any given day, 97% of day traders lose money net of trading fees. This data suggests that new investors decide to begin day trading only because they are overconfident in their ability to be profitable at it.

Why 95% of traders lose

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices. First, investors need a guidebook/mentor/course to help or guide them in daily trading.

Why 95% of traders fail

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices. First, investors need a guidebook/mentor/course to help or guide them in daily trading.

Why Friday is bad for trading

Fridays are generally not a good day to trade forex due to decreased liquidity, increased volatility, and the release of economic data and geopolitical events. In addition, many traders are closing their positions for the weekend, which can lead to unexpected price movements.

Why is Friday a bad day to trade

Fridays usually have high volatility and can be the most volatile day of the week. The difficulty with trading on a Friday is traders can be tired after a long week of trading and make poor decisions.

Why do 90 percent of forex traders fail

Overtrading. Overtrading – either trading too big or too often – is the most common reason why Forex traders fail. Overtrading might be caused by unrealistically high profit goals, market addiction, or insufficient capitalization.

What is the safest time to trade forex

The U.S./London markets overlap (8 a.m. to noon EST) has the heaviest volume of trading and is best for trading opportunities. The Sydney/Tokyo markets overlap (2 a.m. to 4 a.m.) is not as volatile as the U.S./London overlap, but it still offers opportunities.

What is the 50% rule in trading

It states that if an asset drops after a price increase, it will lose between 50% and 67% of recent price gains before rebounding. Technical analysts use the fifty percent principle to identify a good entry point into a particular stock and ensure that there support levels to prevent further drops.

What is the 50 50 rule in trading

As per this formula, investors should invest 50 per cent of their money in the equity market and 50 per cent in the debt market, and balance it from time to time. For example, if an investor wants to pumps in Rs 1,000 in total in the stock market, then he or she should invest Rs 500 in Debt and Rs 500 in equity.

What is the 1% rule in trading

This rule means that you must never risk more than 1% of your account value on a single trade. You can use all your capital or more (via MTF) on a trade but you must take steps to prevent losses of more than 1% in one trade.