Is undervalued or overvalued stock better

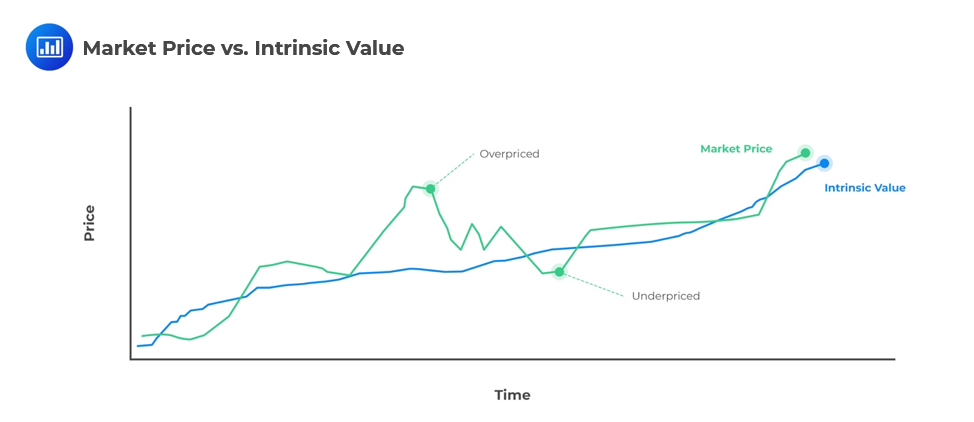

Generally, undervalued shares are favored over overvalued ones, as the investors buy low and sell high. If the company is performing well, it can give promising returns. Buying an overvalued share doesn't have this advantage, as the price returns to its intrinsic value, which is lower.

Is it good if a stock is undervalued

Investors benefit if they buy undervalued stocks because it is possible that the price could rise again in the future, allowing them to sell for more than they paid. However, there are also disadvantages to buying undervalued stocks because it is possible that the price could drop even further in the future.

Why is it bad if a stock is overvalued

What Is "Overvalued" An overvalued stock has a current price that is not justified by its earnings outlook, known as profit projections, or its price-earnings (P/E) ratio. Consequently, analysts and other economic experts expect the price to drop eventually.

Is it good to sell overvalued stocks

When a stock becomes extremely overvalued, it often has nowhere to go but down. Now, I wouldn't recommend selling a stock every time you think it's trading slightly above its fair value. In fact, it's not uncommon for the best companies to be fairly valued or slightly overvalued.

Do undervalued stocks always go up

Understanding Undervalued

Value investing is not foolproof, however. There is no guarantee as to when or whether a stock that appears undervalued will appreciate.

Is overvalued a profit or loss

When the closing stock is overvalued, it results in an increase in the cost of goods sold and a decrease in the gross profit. This, in turn, leads to a decrease in the profit of a business. The following are the reasons how overvaluation of closing stock can decrease the profit: 1.

What happens if the stock is overvalued

Overvalued stocks are the ones that trade above their intrinsic value or their actual worth, due to which it has a great chance of experiencing a sudden sharp price fall at some point of time. The most important thing about overvalued stock calculation is the P/E ratio.

Why is undervalued good

Advantages of Undervalued Stock

Prices of undervalued stocks automatically return to their original value or intrinsic value, which is why profits are assured. It presents an opportunity to purchase shares at low prices from well-established or promising companies.

What is overvalued vs undervalued in accounting

When a stock is overvalued, it presents an opportunity to go “short” by selling its shares. When a stock is undervalued, it presents an opportunity to go “long” by buying its shares. Hedge funds and accredited investors sometimes use a combination of short and long positions to play under/overvalued stocks.

What happens when assets are overvalued

An overvalued asset is an asset that's trading for more than its intrinsic value. Put another way, it's an asset whose current price is not matched by its earnings outlook (profit projections). This is easy to understand in action.

Is high PE ratio good

If the share price falls much faster than earnings, the PE ratio becomes low. A high PE ratio means that a stock is expensive and its price may fall in the future. A low PE ratio means that a stock is cheap and its price may rise in the future. The PE ratio, therefore, is very useful in making investment decisions.

What are the disadvantages of undervalued currency

Drawbacks of UndervaluationEffective protection against imports through undervaluation means reduced competition, which could also make local firms less competitive.In a country with a limited labor supply, the excess demand for jobs could escalate wages, which in turn could increase inflation in general.

Is Tesla stock Overvalued

“Tesla's (TSLA) second quarter earnings confirm our view that the stock is one of the most overvalued stocks in the market,” the veteran analyst wrote in a Thursday note.

What are the benefits of overvalued currency

Advantages of Overvaluation:

Overvaluation means that imports are cheaper in the local currency. This can be crucial for import-dependent populations or where basic necessities (e.g., food, medicines, energy) in emerging countries have to be imported for the local market.

What is the disadvantage of overvalued currency

An overvalued exchange rate means that the countries exports will be relatively expensive and imports cheaper. An overvalued exchange rate tends to depress domestic demand and encourage spending on imports. An overvalued exchange rate is particularly a problem during a period of sluggish growth.

What is the perfect PE ratio

Typically, the average P/E ratio is around 20 to 25. Anything below that would be considered a good price-to-earnings ratio, whereas anything above that would be a worse P/E ratio. But it doesn't stop there, as different industries can have different average P/E ratios.

Does high PE ratio mean overvalued

The P/E ratio is calculated by dividing the market value price per share by the company's earnings per share. A high P/E ratio can mean that a stock's price is high relative to earnings and possibly overvalued. A low P/E ratio might indicate that the current stock price is low relative to earnings.

What are the advantages of overvalued currency

Advantages of Overvaluation:

Overvaluation means that imports are cheaper in the local currency. This can be crucial for import-dependent populations or where basic necessities (e.g., food, medicines, energy) in emerging countries have to be imported for the local market.

What are the advantages of an undervalued currency

A cheaper (undervalued) currency renders the nation's goods (exports) more affordable in the global market while making imports more expensive. After an intermediate period, imports will be forced down and exports to rise, thus stabilizing the trade balance and bring the currency towards equilibrium.

Is Tesla the most overvalued company

Shares of Tesla Inc. and Netflix Inc. are "terribly overvalued," according to independent equity research firm New Constructs. "Tesla's second-quarter earnings confirm our view that the stock is one of the most overvalued stocks in the market," wrote New Constructs CEO David Trainer, in a note.

Why do people think Tesla is overvalued

Tesla Valuation: Price / Earnings Ratio

Using P/E ratio, Tesla is far more expensive than other car makers like GM and Ford. Tesla trades for 54 times historic earnings, and 48 times estimated future earnings. That's 6-7 times the corresponding multiples of its gasoline-powered rivals.

Who benefits from an overvalued currency

Advantages of Overvaluation:

This can be crucial for import-dependent populations or where basic necessities (e.g., food, medicines, energy) in emerging countries have to be imported for the local market. Overvaluation also increases political stability.

Is low or high PE ratio better

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors. The metric is the stock price of a company divided by its earnings per share.

What is the safest PE ratio

In simple terms, a good P/E ratio is lower than the average P/E ratio, which is between 20–25. When looking at the P/E ratio alone, the lower it is, the better.

Is high PE good or bad

A high ratio means the stock is overvalued. However, a high ratio often signifies that it is a growth stock, meaning there is a chance of high future performance, even if the cost per share is high at the moment. However, growth stocks are also volatile, meaning they can be risky investments.