Who produces the most lithium in the world

Australia

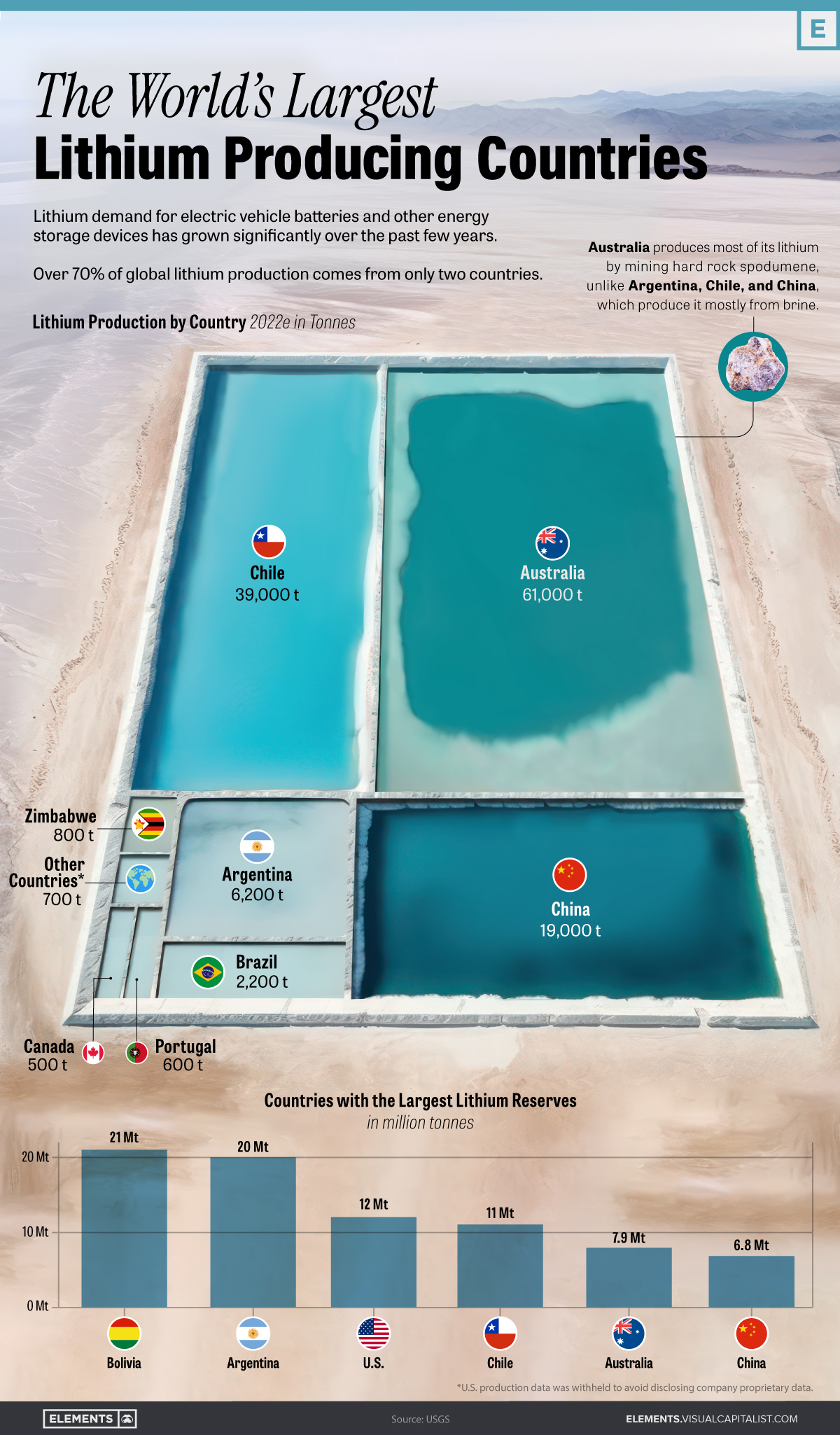

Lithium is currently produced from hard rock or brine mines. Australia is the world's biggest supplier, with production from hard rock mines. Argentina, Chile and China mainly produce it from salt lakes.

Where does Tesla get its lithium

Tesla officially broke ground Monday on a Texas lithium refinery, making it the only U.S. automaker to refine its own lithium. CEO Elon Musk said the refinery will produce enough battery-grade lithium for 1 million electric vehicles by 2025, which would make Tesla the largest processor of lithium in North America.

Who is the largest user of lithium

China's the largest consumer of lithium because of its booming electronics and electric vehicle industries.

Who is the largest lithium battery factory

CATL. Contemporary Amperex Technology Co. Limited, also known simply as CATL, is a Chinese battery company that manufactures lithium-ion EV batteries. Currently the biggest lithium-ion battery manufacturers on the planet, CATL is responsible for the creation of 96.7 gigawatt hours (GWh) of the planet's 296.8 GWh.

What country is richest in lithium

World reserves

| Ranking | Country | Lithium content (tonnes) |

|---|---|---|

| 1 | Chile | 9,200,000 |

| 2 | Australia | 5,700,000 |

| 3 | Argentina | 2,200,000 |

| 4 | China | 1,500,000 |

What 3 countries make the most lithium

The Top 10 Lithium-Producing Countries

| Rank | Country | % of Total |

|---|---|---|

| #1 | Australia | 52% |

| #2 | Chile | 25% |

| #3 | China | 13% |

| #4 | Argentina | 6% |

What is the best lithium stock to invest in

Best lithium stocks

| Ticker | Company | Performance (1 Year) |

|---|---|---|

| ENVX | Enovix Corporation | 119.48% |

| ENS | EnerSys | 79.14% |

| LTHM | Livent Corporation | 25.55% |

| TSLA | Tesla, Inc. | 23.80% |

Will Tesla mine its own lithium

It will make Tesla (ticker: TSLA) the only North American car maker to refine its own lithium. “Increasing lithium refining capacity is critical to a sustainable energy economy—today we're breaking ground on our in-house lithium refinery outside of Corpus Christi, Texas,” the company said in a statement on Twitter.

Which country mines the most lithium

The Top 10 Lithium-Producing Countries

| Rank | Country | % of Total |

|---|---|---|

| #1 | Australia | 52% |

| #2 | Chile | 25% |

| #3 | China | 13% |

| #4 | Argentina | 6% |

Who controls the lithium market

China's position in downstream supply chains for the battery metal is even more dominant. The country only mines 13% of the world's lithium but controls 44% of global lithium chemical production, 78% of cathode production and 70% of cell manufacturing for the electric car industry, news agencies reported.

Who are the top 5 lithium producers

Australia and Chile: Dominating Global Lithium Supply

| Rank | Country | Share (%) |

|---|---|---|

| 1 | 🇦🇺 Australia | 46.9% |

| 2 | 🇨🇱 Chile | 30.0% |

| 3 | 🇨🇳 China | 14.6% |

| 4 | 🇦🇷 Argentina | 4.8% |

Who is the biggest lithium battery producer in China

Top 10 Lithium-ion Battery Manufacturers in China 2023Tritek.CATL.GOTION High Tech.CALB.BYD.EVE.REPT.Great Power.

Is China rich in lithium

In recent years, China has mainly relied on imports to meet domestic requirements for lithium carbonate products although China is one of the countries rich in lithium source reserves.

Does China dominate lithium

China's position in downstream supply chains for the battery metal is even more dominant. The country only mines 13% of the world's lithium but controls 44% of global lithium chemical production, 78% of cathode production and 70% of cell manufacturing for the electric car industry, news agencies reported.

Is lithium a risky investment

The potential risks of investing in lithium

There is also a risk that government support could slow, or EV demand slows. There is talk about sodium-ion batteries coming to the market and competing with lithium-ion batteries. And should they be rolled out, it may cause price pressures for lithium companies.

Is lithium a good investment now

Lithium demand is expected to grow 7x between 2021 and 2030, driven by three key factors1: the growth of EVs, rising demand for renewable energy, and lithium's use in consumer electronics.

Where is Elon Musk’s lithium mine

Corpus Christi

Tesla and Elon Musk break ground at the site of the electric carmaker's new lithium refinery in Corpus Christi, the first of its kind in North America, which will cost $1 billion upon completion.

Does China own most lithium mines

The country only mines 13% of the world's lithium but controls 44% of global lithium chemical production, 78% of cathode production and 70% of cell manufacturing for the electric car industry, news agencies reported.

Where does China import lithium from

Chile

Among them, Chile is China's main source of lithium carbonate imports. In 2021, China imports 64,000 tons of lithium carbonate from Chile, accounting for 78.7% of total imports, and imports of US$390 million, accounting for 69.4% of total imports.

What country owns the most lithium

One third of the “lithium triangle” in South America – which also comprises second and third-placed Argentina and Chile – Bolivia is home to the world's biggest lithium reserves.

Why does China control lithium

Lithium is important to the manufacture of electric vehicle batteries and because China is the world's biggest market for new energy vehicles, lithium is particularly critical to its electric vehicle manufacturing industry.

Who is the biggest lithium miner in the world

Who is the largest miner of lithium The world's largest lithium-producing mine is Talison Lithium and Albemarle's Greenbushes hard-rock mine in Australia, which put out 37,000 MT of lithium in concentrate in 2022.

What is the best lithium stock

Best lithium stocks

| Ticker | Company | Performance (1 Year) |

|---|---|---|

| ENVX | Enovix Corporation | 119.48% |

| ENS | EnerSys | 79.14% |

| LTHM | Livent Corporation | 25.55% |

| TSLA | Tesla, Inc. | 23.80% |

What country has the best lithium

Out of the 26 million tons of global lithium reserves as per the U.S. Geological Survey published in January 2023, Chile was home to the largest lithium reserves base with 9.3 million tons of proven lithium reserves. Australia was ranked #2 based on the lithium reserves with a reserve base of nearly 6.2 million tons.

Why are lithium stocks so low

Shares in lithium producers have tumbled this year after sharp falls in spot prices driven by slowing demand for electric vehicles in China, leaving investors worried the 2022 boom has turned to bust.