Is IFRS applicable in China

Yes. What is the jurisdiction's status of adoption China has adopted national accounting standards that are substantially converged with IFRS Standards.

Why have some countries not adopted IFRS

In countries where the quality of extant governance institutions is relatively high, IFRS adoption is likely to be less attractive. High quality institutions represent high opportunity and switching costs to adopting international accounting standards.

How is China accounting standard different from IFRS

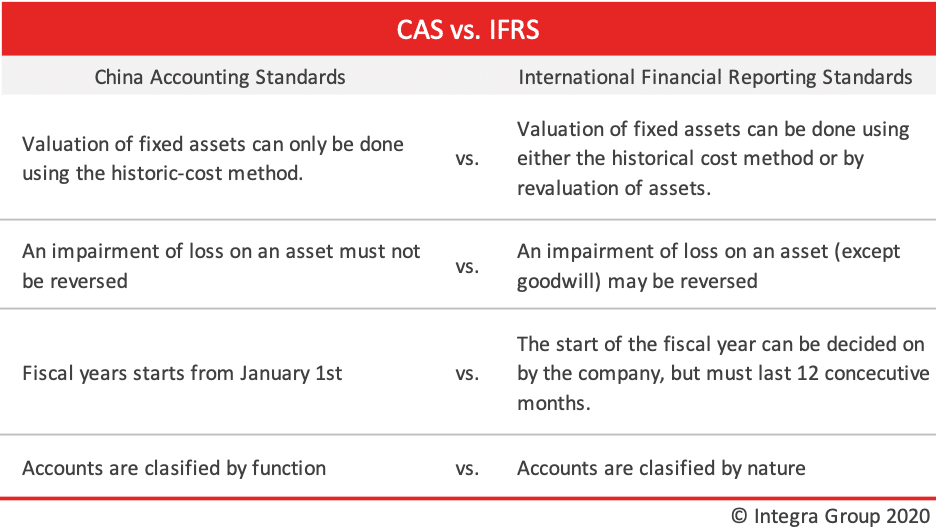

Chinese accounts are generally classified by function, as opposed to the international standard to classify them by their nature. Businesses that use IFRS have the option of choosing their preferred method of valuation for certain types of fixed assets.

When did China adopt IFRS

On 15 February 2006, the Ministry of Finance of the People's Republic of China issued a new set of Accounting Standards for Business Enterprises (ASBEs), which are substantially converged with IFRSs. All companies listed in China must apply ASBEs for the preparation of their financial statements.

Does China use GAAP or IFRS

Since 1992 the Chinese Ministry of Finance has worked on the gradual implementation of the Chinese Generally Accepted Accounting Principles, or China GAAP, also known as the Chinese Accounting Standards.

Why did China adopt IFRS

A primary goal of China's IFRS adoption is to attract greater foreign investment (MOF, 2006). Prior research has generally found positive capital market consequences following mandatory IFRS adoption (Daske et al., 2008, Li, 2010, Tan et al., 2011, DeFond et al., 2011).

Which countries don’t use IFRS

Moreover, as I had analyzed in another article, 'The Political Economy of International Standard Setting in Financial Reporting: How the United States Led the Adoption of IFRS Across the World', the United States remains the only developed country that has not adopted IFRS, yet US institutions played a central role in …

Which country does not use IFRS

Moreover, as I had analyzed in another article, 'The Political Economy of International Standard Setting in Financial Reporting: How the United States Led the Adoption of IFRS Across the World', the United States remains the only developed country that has not adopted IFRS, yet US institutions played a central role in …

Which country has not adopted IFRS

Moreover, as I had analyzed in another article, 'The Political Economy of International Standard Setting in Financial Reporting: How the United States Led the Adoption of IFRS Across the World', the United States remains the only developed country that has not adopted IFRS, yet US institutions played a central role in …

Does Japan use IFRS

IFRS Standards are one of four permitted financial reporting frameworks. The others are Japanese GAAP, Japan's Modified International Standards (JMIS), and US GAAP. Permitted.

Why do most countries use IFRS

By adopting IFRS, a business can present its financial statements on the same basis as its foreign competitors, making comparisons easier. Furthermore, companies with subsidiaries in countries that require or permit IFRS may be able to use one accounting language company-wide.

Does Russia use IFRS

Yes. IFRS Standards are part of the Russian accounting and reporting regulation: the Federal Laws 208-FZ On Consolidated Financial Statements and 402-FZ On Accounting.

Which country has not accepted IFRS

Moreover, as I had analyzed in another article, 'The Political Economy of International Standard Setting in Financial Reporting: How the United States Led the Adoption of IFRS Across the World', the United States remains the only developed country that has not adopted IFRS, yet US institutions played a central role in …

What are the disadvantages of IFRS

Compared to GAAP, IFRS is less detailed. Implementation expenses are another important disadvantage of IFRS. Each nation adopting the new standards would be required to cover the expenses of retraining and education for the accounting profession.

Does Ukraine use IFRS

Ukraine has adopted IFRS Accounting Standards for companies, meeting the criteria specified in legislation.

Do all countries use IFRS

Approximately 120 nations and reporting jurisdictions permit or require IFRS for domestic listed companies, although approximately 90 countries have fully conformed with IFRS as promulgated by the IASB and include a statement acknowledging such conformity in audit reports.

Why is GAAP better than IFRS

Which is better IFRS or GAAP It depends on the context. Generally speaking, IFRS is more widely used globally and is better for companies that operate in multiple countries, while GAAP is more focused on the US and is better for companies that only operate in the US.

Which of the following countries does not use the IFRS standards

Moreover, as I had analyzed in another article, 'The Political Economy of International Standard Setting in Financial Reporting: How the United States Led the Adoption of IFRS Across the World', the United States remains the only developed country that has not adopted IFRS, yet US institutions played a central role in …

Why does US use GAAP and not IFRS

Declaring (and rightfully so) that their main goal is to protect US investors' interests, the SEC notes that IFRS lacks consistent application, allows too much leeway with judgment, and is underdeveloped in many specific areas, for which the US GAAP has detailed and accepted guidance and established practice ( …

Is GAAP or IFRS more accurate

GAAP offers a rules-based scenario, while IFRS is more about principles. IFRS will work for organizations looking to capture their transactions more accurately.

Why IFRS is not implemented in the US

Declaring (and rightfully so) that their main goal is to protect US investors' interests, the SEC notes that IFRS lacks consistent application, allows too much leeway with judgment, and is underdeveloped in many specific areas, for which the US GAAP has detailed and accepted guidance and established practice ( …

Why IFRS is better than GAAP

GAAP is more detailed and prescriptive while IFRS is more high-level and flexible. GAAP requires more disclosures while IFRS requires fewer disclosures. GAAP is more focused on the historical cost of assets while IFRS allows for more flexibility in the valuation of assets.