What are the benefits of market crash

But here's the thing: A market crash creates opportunities, especially for savvy investors. You may be able to splurge on stocks and funds you've had your eyes on at steep discounts—or you can simply continue buying shares on your regular investing schedule.

Is it good to invest when the market crashes

Get more long-term investments

This is a perfect opportunity to invest in long-term stocks is right when the market is hit the rock bottom. The reason for this is simple, long-term stocks that last for over 10-25 years yield more profit because of the indirect impact of deflation and high-profit margins.

How did the stock market crash help cause the Great Depression

The 1929 crash didn't cause the Great Depression outright, with only 10% of Americans invested in the market, but it lowered consumer spending, caused panic that worsened an ongoing recession, reduced corporations' assets and hurt their future prospects, and contributed to a banking crisis.

Is a stock market crash bad for the economy

While a fall in share prices has a negative impact on the economic growth and GDP of a nation, it has a positive effect on the bond market. When there is a depression in the stock market, people look for other assets to invest their money in such as bonds or gold.

How can we benefit from economic crash

5 Things to Invest in When a Recession HitsSeek Out Core Sector Stocks. During a recession, you might be inclined to give up on stocks, but experts say it's best not to flee equities completely.Focus on Reliable Dividend Stocks.Consider Buying Real Estate.Purchase Precious Metal Investments.“Invest” in Yourself.

Who benefits from a financial crash

In a recession, the rate of inflation tends to fall. This is because unemployment rises moderating wage inflation. Also with falling demand, firms respond by cutting prices. This fall in inflation can benefit those on fixed incomes or cash savings.

How can we take advantage of a recession

You need to plan ahead to position your investment portfolio for an economic downturn, even if the next recession is forecasted to be mild.Cash Is King During a Recession.Own Defensive Stocks in a Recession.Use Dollar-Cost Averaging.Buy Quality Assets During a Recession.Avoid Growth Stocks During a Recession.

What goes up when market crashes

Gold, silver and bonds are the classics that traditionally stay stable or rise when the markets crash. We'll look at gold and silver first. In theory, gold and silver hold their value over time. This makes them attractive when the stock market is volatile, and the increased demand drives the prices up.

Who benefited from the Great Depression

Business titans such as William Boeing and Walter Chrysler actually grew their fortunes during the Great Depression.

Who profited from the stock market crash of 1929

The classic way to profit in a declining market is via a short sale — selling stock you've borrowed (e.g., from a broker) in hopes the price will drop, enabling you to buy cheaper shares to pay off the loan. One famous character who made money this way in the 1929 crash was speculator Jesse Lauriston Livermore.

Does the stock market benefit the economy

The stock market enables companies to raise money and the public to profit from their growth prospects. When all goes to plan, this is a win-win for the economy.

What actually happens if the stock market crashes

Stock market crashes wipe out equity-investment values and are most harmful to those who rely on investment returns for retirement. Although the collapse of equity prices can occur over a day or a year, crashes are often followed by a recession or depression.

How can you benefit from inflation

What are the best investments to make during inflationReal estate. Real estate is almost always an excellent investment and should be at the top of your list.Savings bonds.Stocks.Silver and gold.Commodities.Cryptocurrency.

What do people buy most during a recession

Consumer staples, including toothpaste, soap, and shampoo, enjoy a steady demand for their products during recessions and other emergencies, such as pandemics. Discount stores often do incredibly well during recessions because their staple products are cheaper.

Who benefited the most from the Great Recession

Generally, richer households have disproportionately benefited from the boom in the stock market during the recovery, with the Dow Jones industrial average more than doubling in value since it bottomed out early in 2009. About half of households hold stock, directly or through vehicles like pension accounts.

Is it good to save in a recession

Should You Keep Saving During a Recession Yep. Having savings goals is never a bad idea, even during a recession.

Where does all the money go when the market crashes

The most straightforward answer to this question is that it actually disappeared into thin air, due to the decrease in demand for the stock, or, more specifically, the decrease in enough investors' favorable perceptions of it to move the price down by selling.

What good things did the Great Depression do

Among the legacies of the Great Depression were some durable innovations to make individual lives and many economic sectors less risky, including both the old-age pension and unemployment-relief features of the Social Security Act of 1935, federal programs to make mortgage lending and home-ownership more accessible, …

Why was the Great Depression a good thing

By 1939, federal outlays exceeded 10 percent of GDP. 1 (At present, federal spending accounts for about 20 percent of GDP.) The Great Depression also brought us the Federal Deposit Insurance Corp. (FDIC), regulation of securities markets, the birth of the Social Security System and the first national minimum wage.

Did anyone benefit from the Great Depression

Not everyone, however, lost money during the worst economic downturn in American history. Business titans such as William Boeing and Walter Chrysler actually grew their fortunes during the Great Depression.

What thrived during the Great Depression

Within the overall upswing, the main expansion occurred during the 1922 to 1923 and 1928 to 1929 periods, and it was most pronounced in the automobile, electrical goods, and (to 1926) construction industries.

Why is the stock market good for a country

Stock market raises capital for long-term investments, mobilizes savings and encourages investment. It is highly correlated with the development of banks, pension funds and other financial intermediaries. Developed stock markets reduce liquidity shocks and productivity shocks.

Do stock markets promote economic growth

With stock prices rising, investors and consumers have more wealth and optimism about future prospects. This confidence spills over into increased spending, which can lead to major purchases, such as homes and automobiles. The result leads to increased sales and earnings for corporations, further boosting GDP.

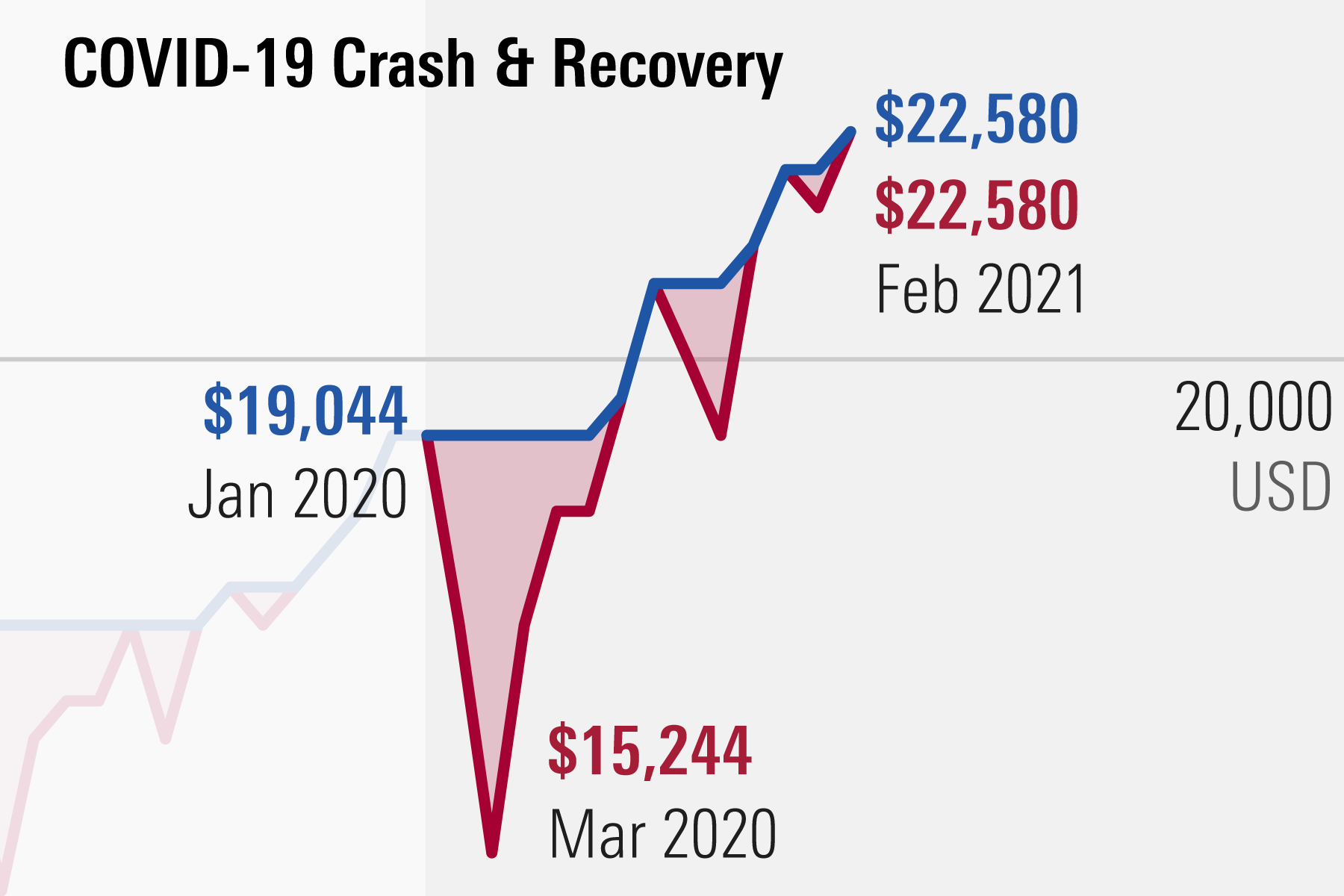

Does the stock market crash every 7 years

Since those reforms, the stock market has crashed in 2000, 2008 and 2020, roughly once every seven years, with the 2022 crash brought on by the coronavirus.

Should a 75 year old be in the stock market

Seniors should consider investing their money for several reasons: Generate Income: Investing in income-generating assets, such as stocks, bonds, or real estate, can provide a steady income stream during retirement. This can be especially important for seniors who no longer receive a regular paycheck from work.